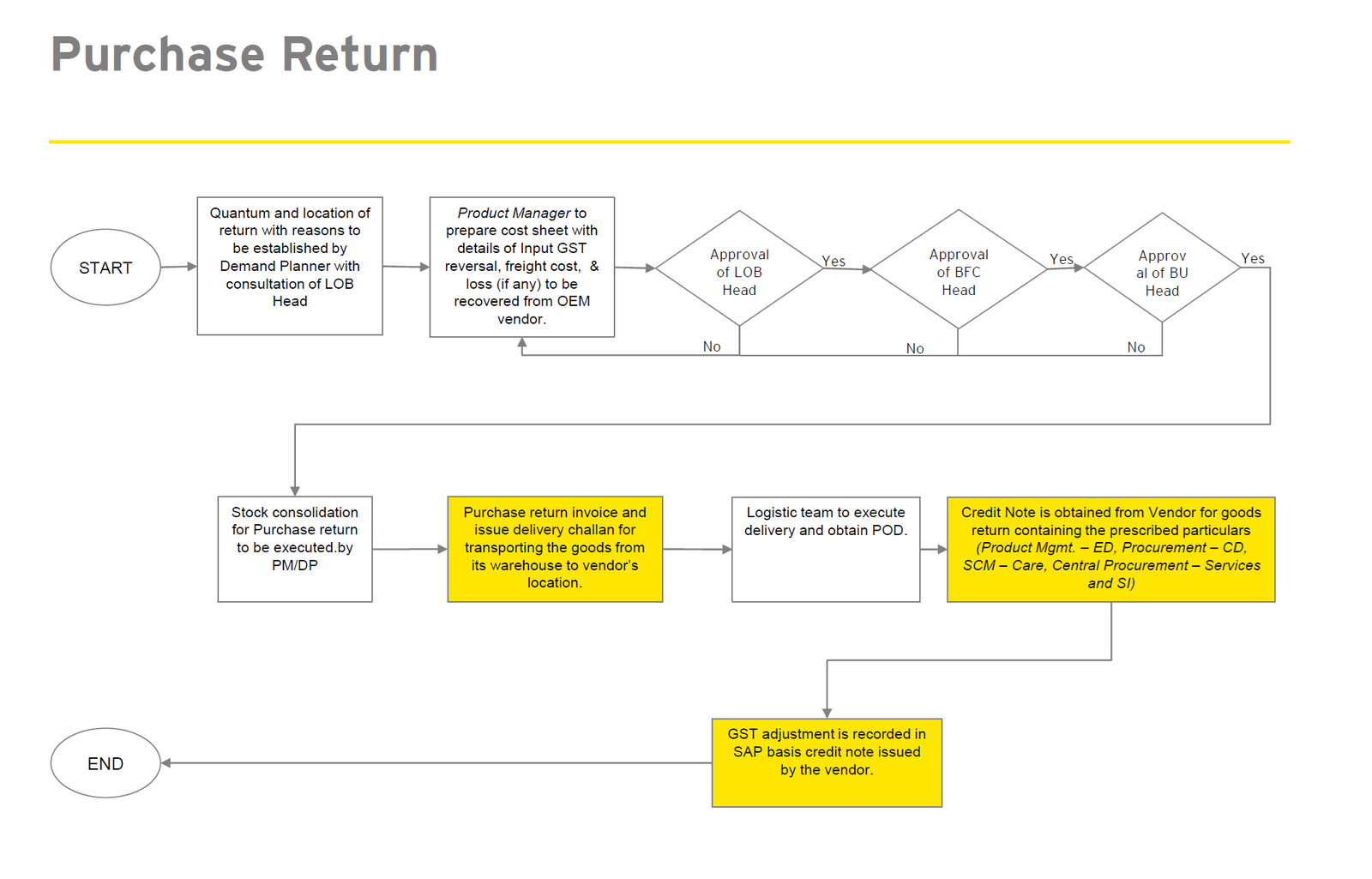

The flowchart describes the Purchase Return (a.k.a. Vendor Return) process in SAP, detailing the steps required from initiating a return to the final adjustments of GST and processing of credit notes. Here’s a detailed breakdown of the process:

- Establishing Return Details: The process begins with determining the quantity and location of the return, along with the reasons for the return. This is done by the Demand Planner in consultation with the Head of Line of Business (LOB).

- Cost Analysis (Cost Sheet Preparation): The Product Manager prepares a cost sheet detailing the Input GST reversal, freight costs, and any potential losses to be recovered from the OEM vendor.

- Approval Process:

- LOB Head Approval: The cost sheet and return plan require approval from the LOB head.

- BFC Head Approval: If approved by the LOB head, it moves to the BFC (Business Finance Controller) head for further approval.

- BU Head Approval: Following approval from the BFC head, the Business Unit (BU) head must also approve the return.

- Execution of Return:

- Stock Consolidation: Once approvals are obtained, the stock is consolidated for the purchase return by the Product Manager/Demand Planner.

- Issuing Return Invoice and Delivery Challan: A purchase return invoice and a delivery challan are issued for transporting the goods from the warehouse to the vendor’s location.

- Goods Shipment and Confirmation: The logistics team is responsible for executing the delivery of the returned goods and obtaining a Proof of Delivery (POD).

- Credit Note and Financial Adjustments:

- Credit Note Receipt: A credit note is obtained from the vendor, containing the prescribed particulars (managed by departments such as Product Management – ED, Procurement – CD, SCM – Care, Central Procurement – Services and SI).

- GST Adjustment: If a credit note is issued, GST adjustments are recorded in SAP. This ensures that all financial implications of the return are correctly accounted for.

- Process Completion: The process concludes once all steps are completed, ensuring the return is processed, approved, and financially settled within SAP.

This flowchart effectively outlines a structured approach to managing purchase returns in SAP, ensuring compliance with financial policies and streamlined handling of logistics and stock adjustments.