Down payments are a common business practice, especially when securing goods or services for large projects or from new vendors. In SAP S/4HANA Finance, managing down payments is a streamlined process designed to maintain financial transparency and accuracy. While the technical steps are important, understanding the financial impact and the underlying accounting logic is the main focus of this post.

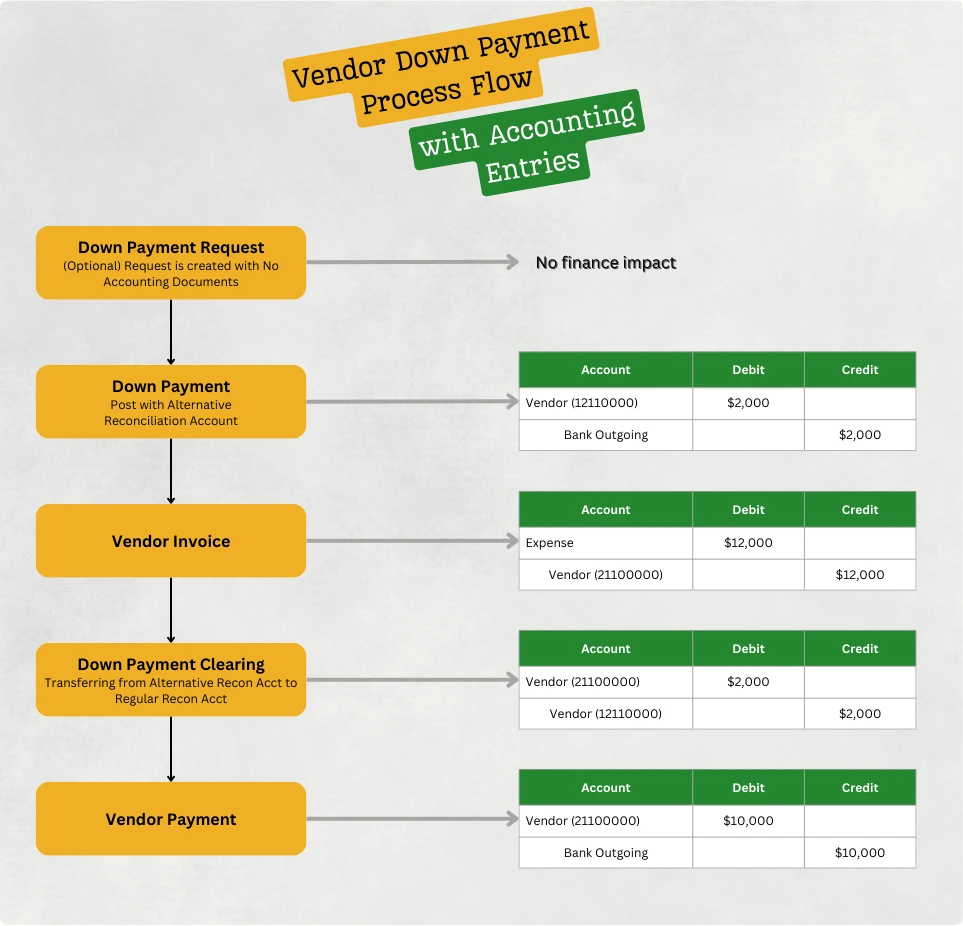

Attached image illustrates down payment process flow within SAP, focusing specifically on the financial accounting implications at each stage. You will explore how each step impacts your financial statements through clear accounting entries, providing a finance-centric view rather than a step-by-step transactional guide.

The Down Payment Journey: A Financial Flow

Let’s visualize the down payment process flow and dissect the accounting entries generated in SAP S/4HANA, illustrating the financial story behind each transaction:

1. Down Payment Request (Optional – Finance Neutral)

An optional initial step where a down payment request is created within SAP. This can serve as an internal note or approval workflow trigger.

- Finance Impact: Zero. Creating a down payment request does not generate any accounting documents. It’s purely an operational or pre-authorization step. Think of it as an internal requisition – it signals intent but doesn’t affect the books yet.

2. Posting the Down Payment (Initial Financial Outflow)

- Process Step: This is where the financial action begins. The company makes the actual down payment to the vendor. This is typically done using a Fiori app like “Post Supplier Down Payment”.

- Finance Impact: Creates the initial financial impact. This step represents a cash outflow and the recognition of a prepaid expense (or a down payment asset). SAP cleverly uses Special G/L Accounts to segregate these down payments on the balance sheet.

Account Type Account Description (Example) Debit (Dr) Credit (Cr) Balance Sheet Vendor Down Payment Account (Special GL) $2,000.00 USD Balance Sheet Bank Outgoing Account $2,000.00 USD - Financial Explanation:

- Debit (Dr) to Vendor Down Payment Account: This asset account (typically a Special G/L account linked to the vendor reconciliation account) increases. It represents the value prepaid to the vendor and shown separately on the asset side of the balance sheet.

- Credit (Cr) to Bank Outgoing Account: This asset account (cash) decreases, reflecting the actual cash payment made.

- Financial Explanation:

3. Receiving the Vendor Invoice (Recognizing the Liability and Expense)

- Process Step: When the vendor delivers goods or services, they issue an invoice. This invoice is entered into SAP, often using Fiori apps like “Create Incoming Invoice”. This invoice represents the total value of the goods/services before considering the down payment.

- Finance Impact: Recognizes the expense and the full liability to the vendor. This is the standard invoice posting, acknowledging the incurred expense and the obligation to pay the vendor the total invoice amount (initially).

Account Type Account Description (Example) Debit (Dr) Credit (Cr) Income Statement Expense Account (e.g., Material Expense) $12,000.00 USD Balance Sheet Vendor Reconciliation Account (Regular Payables) $12,000.00 USD - Financial Explanation:

- Debit (Dr) to Expense Account: This expense account increases on the income statement, recognizing the cost of goods or services received.

- Credit (Cr) to Vendor Reconciliation Account: This liability account increases on the balance sheet, representing the company’s obligation to pay the vendor the full invoice amount. Note: At this point, the system doesn’t yet “know” about the down payment against this invoice in terms of this accounting entry.

- Financial Explanation:

4. Clearing the Down Payment (Offsetting Prepaid Expense against Liability)

- Process Step: This crucial step links the down payment made earlier to the vendor invoice. In SAP, this “clearing” process effectively reduces the outstanding liability to the vendor by the amount of the down payment. This can be initiated through Fiori apps designed for down payment clearing.

- Finance Impact: Reduces the vendor liability and eliminates the ‘prepaid expense’ from the special GL account. It transfers the down payment’s effect from the separate “Down Payment” account to the regular vendor payables account.

Account Type Account Description (Example) Debit (Dr) Credit (Cr) Balance Sheet Vendor Reconciliation Account (Regular Payables) $2,000.00 USD Balance Sheet Vendor Down Payment Account (Special GL) $2,000.00 USD - Financial Explanation:

- Debit (Dr) to Vendor Reconciliation Account: This liability account decreases, reducing the amount owed to the vendor by the down payment amount.

- Credit (Cr) to Vendor Down Payment Account: This asset account (Special GL) decreases to zero (or its reduced balance), effectively clearing the prepaid expense as it has now served its purpose of reducing the invoice liability.

- Financial Explanation:

5. Final Vendor Payment (Settling the Remaining Balance)

- Process Step: The final payment is made to the vendor for the remaining balance after deducting the down payment. This is typically managed using automatic payment runs or manual payment postings in SAP.

- Finance Impact: Settles the remaining liability and completes the cash outflow for the purchase.

Account Type Account Description (Example) Debit (Dr) Credit (Cr) Balance Sheet Vendor Reconciliation Account (Regular Payables) $10,000.00 USD Balance Sheet Bank Outgoing Account $10,000.00 USD - Financial Explanation:

- Debit (Dr) to Vendor Reconciliation Account: This liability account decreases to zero, as the remaining balance owed to the vendor is now paid.

- Credit (Cr) to Bank Outgoing Account: This asset account (cash) decreases, reflecting the final cash payment.

- Financial Explanation:

In Conclusion

The down payment process in SAP S/4HANA Finance is more than just a series of transactions; it’s a carefully designed financial flow. By understanding the accounting entries and the financial logic behind each step, finance professionals can effectively manage down payments, ensuring accurate financial reporting, transparent balance sheets, and efficient cash flow management within their organizations. This finance-focused perspective empowers businesses to leverage SAP S/4HANA to its fullest potential in managing this critical aspect of procurement and financial operations.