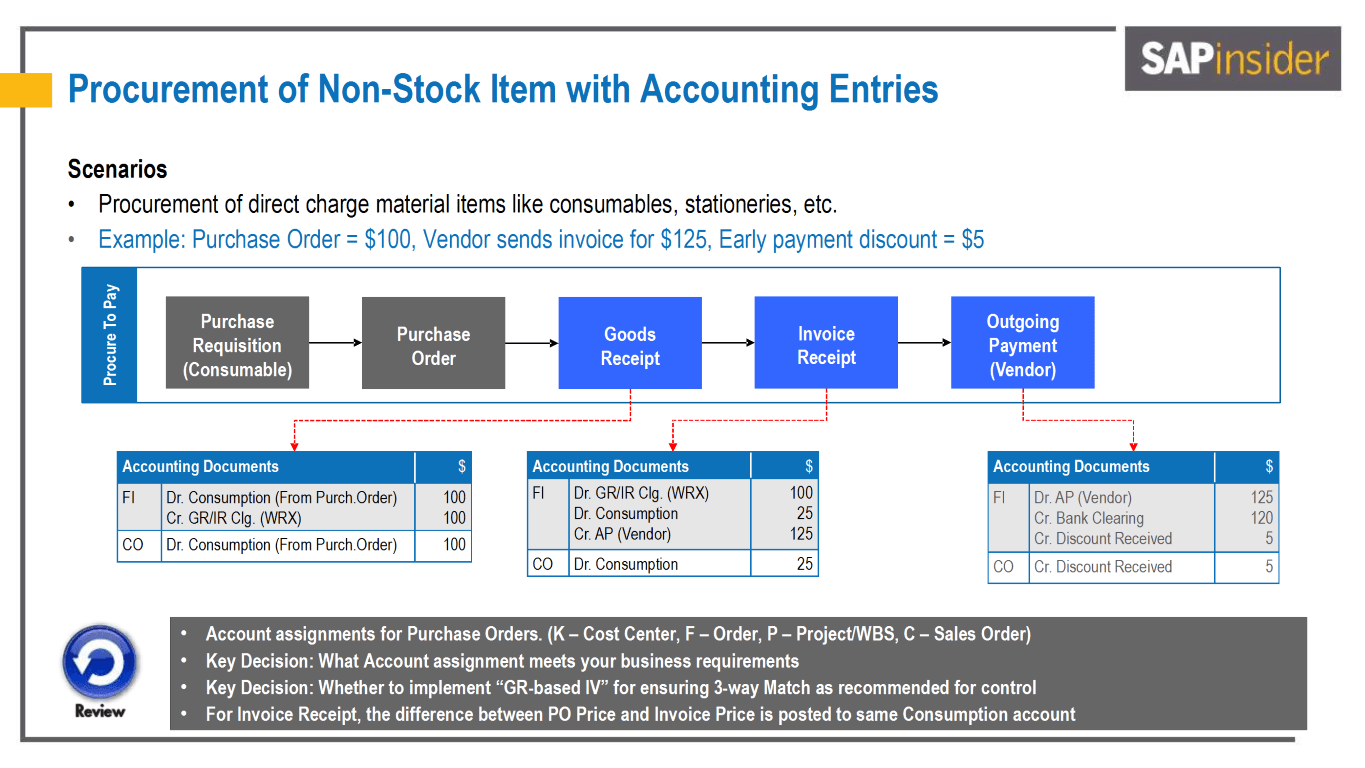

Procurement of non-stock items, such as office supplies, maintenance materials, or other direct-expense consumables, within SAP follows a structured Procure-to-Pay (P2P) cycle. This guide aims to provide a detailed, step-by-step walkthrough of this process, highlighting the key accounting entries, transaction codes, and best practices to ensure accurate financial reporting and efficient procurement operations.

1. Purchase Requisition (pr Consumable) [ME51N]

The procurement process begins with a Purchase Requisition (PR). When a department identifies the need for consumable materials (e.g., stationery, printing supplies), they create a PR to request the items internally. This document initiates the approval process and serves as formal request to the procurement department.

Accounting Impact for PR:

- Financial Postings: None at the PR stage.

- Purpose: The PR is purely an internal request document and does not impact the General Ledger.

2. Purchase Order (PO) [ME21N]

Once the Purchase Requisition is approved, it is converted into a Purchase Order. During this step, the procurement team specifies vendor details, pricing, and any additional costs such as freight charges.

Accounting Impact for PO:

- Financial Postings: Typically, the creation of a PO does not produce direct Financial Accounting (FI) postings.

- Controlling (CO) Impact: A commitment may be recorded in the Controlling module, allowing for tracking against budgets or internal reporting.

3. Goods Receipt (GR) [MIGO]

Upon the arrival of the consumable items, the relevant department performs a Goods Receipt against the Purchase Order. For non-stock items, SAP immediately treats the expense as consumption rather than adding it to inventory.

Example Scenario:

- Expected Cost: $100 for stationery supplies.

- Cost Center: Directly charged to the relevant department or cost center.

Typical Accounting Postings for GR:

- Financial Accounting (FI):

- Debit: Consumption (Expense) ………… $100

- Credit: GR/IR Clearing (WRX) ………… $100

- Controlling (CO):

- Debit: Consumption (Cost Center/Order/Project, etc.)

Note: Since these consumables do not enter warehouse inventory, the debit side is recorded as an expense (consumption). The credited GR/IR Clearing account temporarily holds the liability until the invoice is received.

4. Invoice Receipt [MIRO]

After the vendor sends the invoice, it is processed in SAP. In our example, the invoice total is $125, which is higher than the original Purchase Order amount of $100, possibly due to extra charges or price updates.

Typical Accounting Postings for IR:

- Financial Accounting (FI):

- Debit: GR/IR Clearing (WRX) ………… $100

- Debit: Consumption (Expense) ……… $25

- Credit: Accounts Payable (Vendor) ………… $125

- Controlling (CO):

- Debit: Consumption ………… $25

Note: Any difference between the original PO price and the final invoice (in this case, a $25 difference) is expensed to the same consumption account. In some configurations, a Price Difference account may be used to track overages separately. However, for many non-stock scenarios, the simpler approach of directly hitting consumption is preferred.

5. Outgoing Payment [F110 (Automatic Payment) / F-53 (Manual Payment)]

When it’s time to pay the vendor, SAP clears the Accounts Payable balance and records the cash outflow. In our example, the organization receives a $5 early payment discount, resulting in a payment of $120 instead of the $125 invoice amount.

Typical Accounting Postings for Payments:

- Financial Accounting (FI):

- Debit: Accounts Payable (Vendor) ………… $125

- Credit: Bank (or Bank Clearing) ………… $120

- Credit: Discount Received …………… $5

- Controlling (CO):

- Credit: Discount Received ………… $5

Note: The $5 discount is recognized as reduction in expense, effectively lowering the overall cost of the consumable procurement.

6. Conclusion

Procuring and expensing non-stock items within SAP follows a structured and streamlined Procure-to-Pay cycle: Purchase Requisition → Purchase Order → Goods Receipt (immediate expense) → Invoice Receipt → Outgoing Payment. Each step is intricately linked to specific accounting entries that ensure transparency and accuracy in financial records. By understanding how costs are recorded, managing variances and discounts effectively, and adhering to best practices, organizations can maintain precise budgets, foster strong supplier relationships, and ensure smooth day-to-day operations—all without the complexities of inventory management for items intended for direct use.