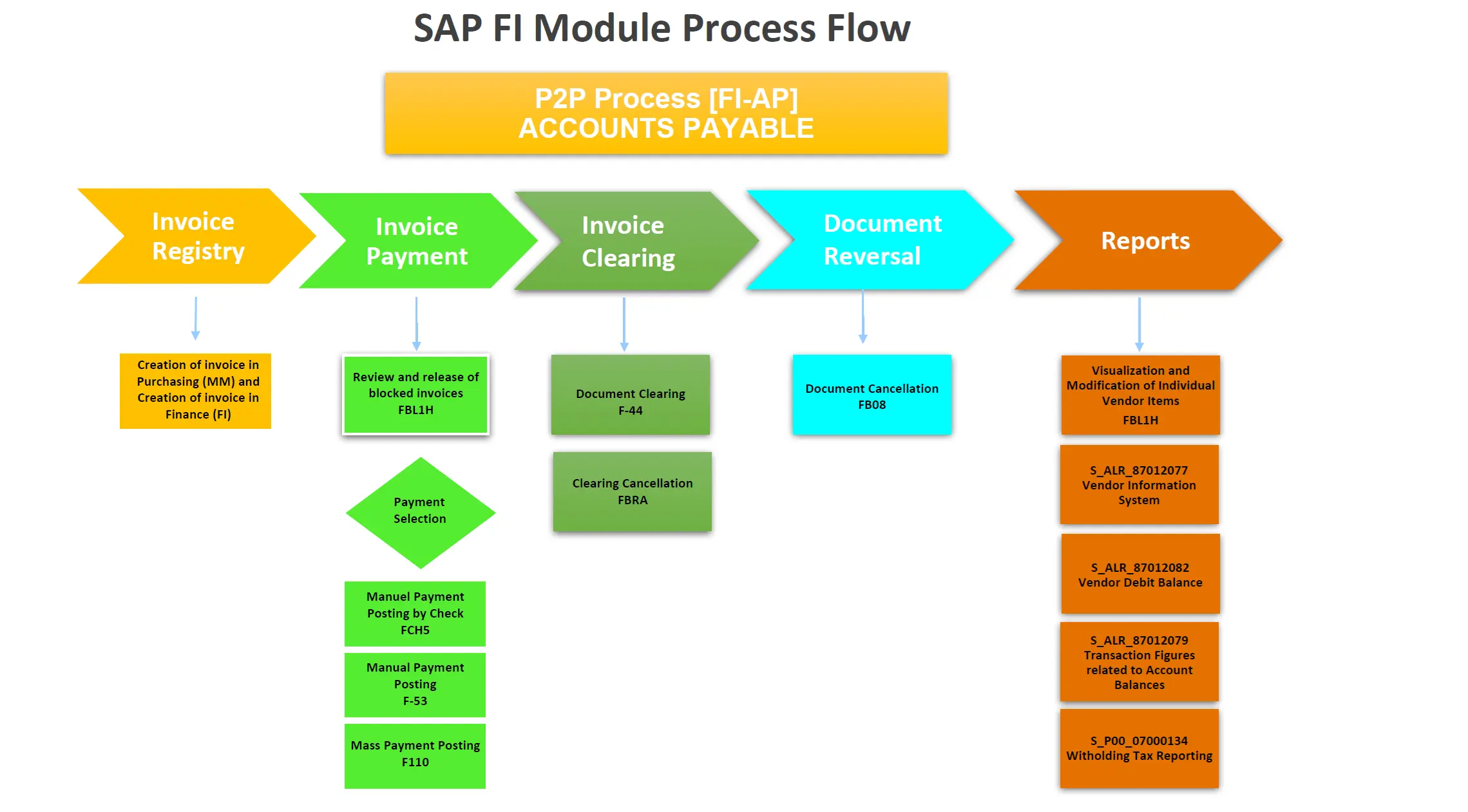

This workflow diagram illustrates the key procedures in the Accounts Payable (AP) process within the SAP FI (Financial Accounting) module, focusing on the Procure-to-Pay (P2P) cycle. The main steps include Invoice Registry, Invoice Payment, Invoice Clearing, Document Reversal, and Reporting.

- Invoice Registry:

- Creation of Invoice in Purchasing (MM) and Finance (FI) 📄: The process starts with the creation of an invoice in the Materials Management (MM) module and subsequently in the Finance (FI) module.

- Invoice Payment:

- Review and Release of Blocked Invoices (FBL1H) ✅: Before payment, any blocked invoices are reviewed and released.

- Payment Selection 💵: This step involves selecting invoices for payment.

- Manual Payment Posting by Check (FCH5) 📝: Option to manually post payments using checks.

- Manual Payment Posting (F-53) 📝: Option for manual posting of payments directly.

- Mass Payment Posting (F110) 📝: Option for bulk payment posting.

- Invoice Clearing:

- Document Clearing (F-44) 📑: Clearing of the invoice document in the system.

- Clearing Cancellation (FBRA) 🚫: Cancellation of clearing if needed.

- Document Reversal:

- Document Cancellation (FB08) ↩️: Reversing the document if necessary.

- Reports:

- Visualization and Modification of Individual Vendor Items (FBL1H) 📊: Viewing and editing vendor-specific items.

- Vendor Information System (S_ALR_87012077) 📈: Comprehensive reporting on vendor information.

- Vendor Debit Balance (S_ALR_87012082) 📉: Reporting on vendor debit balances.

- Transaction Figures Related to Account Balances (S_ALR_87012079) 🔍: Detailed report on transaction figures and account balances.

- Withholding Tax Reporting (S_P00_07000134) 📋: Specific report for withholding tax.

Each step is a crucial part of managing accounts payable efficiently in SAP, ensuring accurate tracking, payment, and reporting of financial transactions related to vendor invoices.