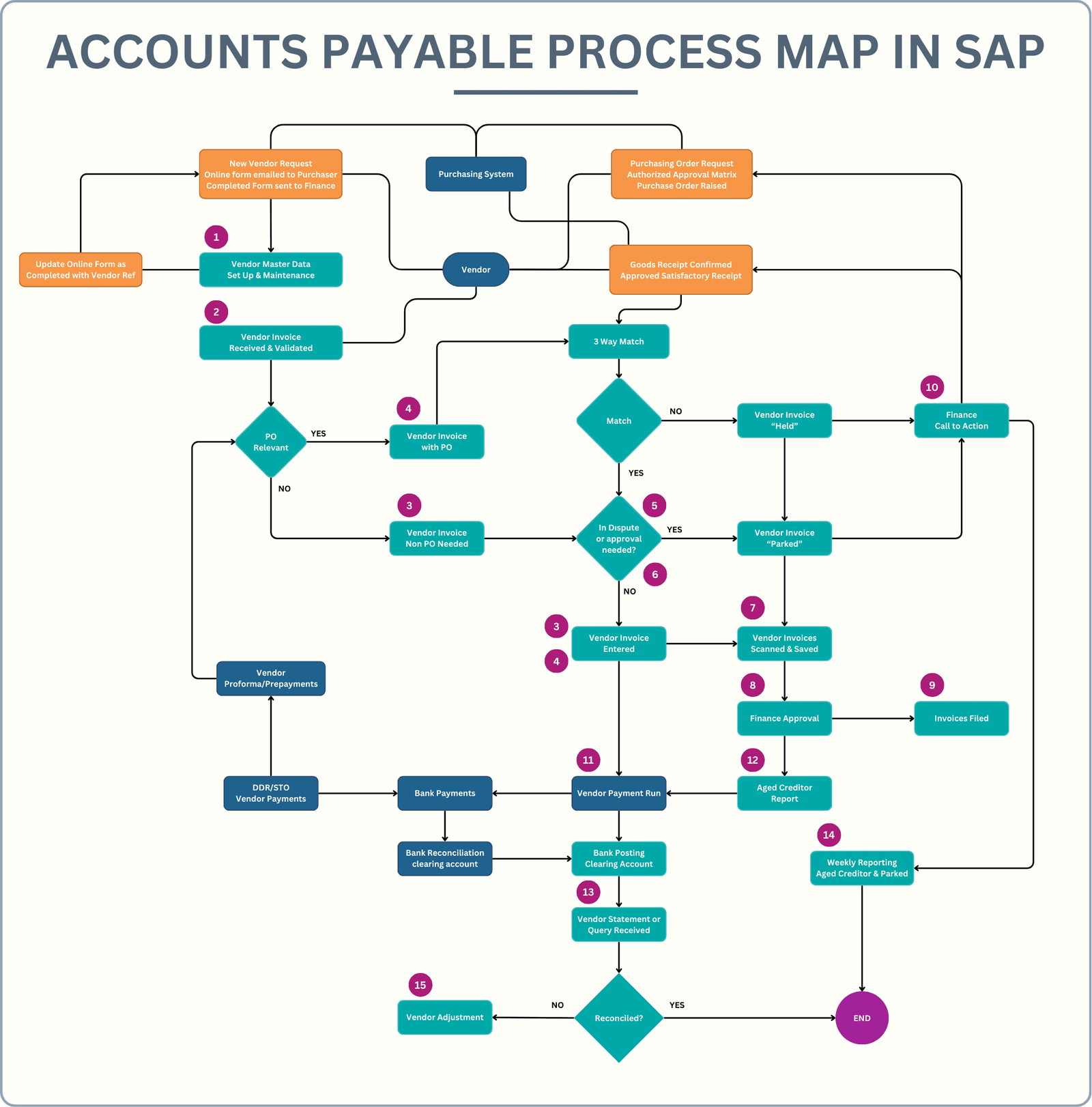

In the provided process map, the process steps within the Accounts Payable (A.P.) procedures are outlined, showcasing the systematic approach to managing vendor interactions and invoice processing in SAP. Below is a detailed description of steps as portrayed in the flowchart:

- Vendor Master Data Set Up & Maintenance (XK01, FK08): This initial step involves the creation or updating of vendor records within SAP. New vendor data is confirmed and validated against necessary documentation and approvals.

- 3-Way Match (ME23N): A critical control point where invoices are matched against purchase orders (PO) and goods receipts to ensure accuracy and alignment across documents.

- Vendor Invoice Entered (FB60): Vendor invoices, whether associated with or without a PO, are entered into the SAP system. If discrepancies in data or validation requirements are identified, invoices may be parked or held for further review.

- Vendor Invoice with PO (MIRO): When an invoice corresponds with an existing PO, it undergoes further scrutiny to ensure all conditions of the purchase order are met before payment processing.

- Dispute or Approval Needed? (XK05, FK02): This decision point evaluates whether the invoice requires additional approval or if there is a dispute involved. This results in either holding the invoice or proceeding to further processing steps.

- Vendor Invoice “Parked” (MRBR): If further validation is necessary, such as awaiting dispute resolution or additional approvals, the invoice is parked within SAP. This action prevents it from affecting the financial ledger.

- Vendor Invoices Scanned & Saved: All processed invoices are digitally archived by scanning and saving in the Accounts Payable directory, ensuring a comprehensive record is maintained.

- Finance Approval (MIR6, FB03): The approval phase assures that all entered invoices or credits, regardless of status (posted, on hold, parked), receive final endorsement from accounting personnel responsible for sign-off.

- Invoice Filed: Hard copy invoices are systematically filed in alphabetical order, organized by vendor for easy retrieval and reference.

- Finance Call to Action: For parked or held transactions, follow-up actions are communicated. This involves sending reminders and escalations to ensure invoices advance towards payment processing without delays.

- Vendor Payment Run (F110): Payments are systematically scheduled and executed via SAP, either through automatic payment runs or manual interventions, before being processed via the bank.

- Aged Creditor Report (S_ALR_87012083): A report that is routinely run to review and validate outstanding creditor positions, ensuring all due payments are adequately captured within the SAP payment run.

- Vendor Statement or Query Received: Vendor statements are cross-checked with SAP records and reconciled. Any issues or discrepancies are flagged for further action to uphold accurate records.

- Weekly Reporting & Aged Creditor & Parked: Weekly control reviews encompass reports on parked or aged transactions, aiming to resolve pending issues and uphold accounting integrity.

- Vendor Adjustments: This closing step involves necessary adjustments such as reversals or movements of vendor-related funds, ensuring all transactions are timely and accurately reflective of the current ledger status.