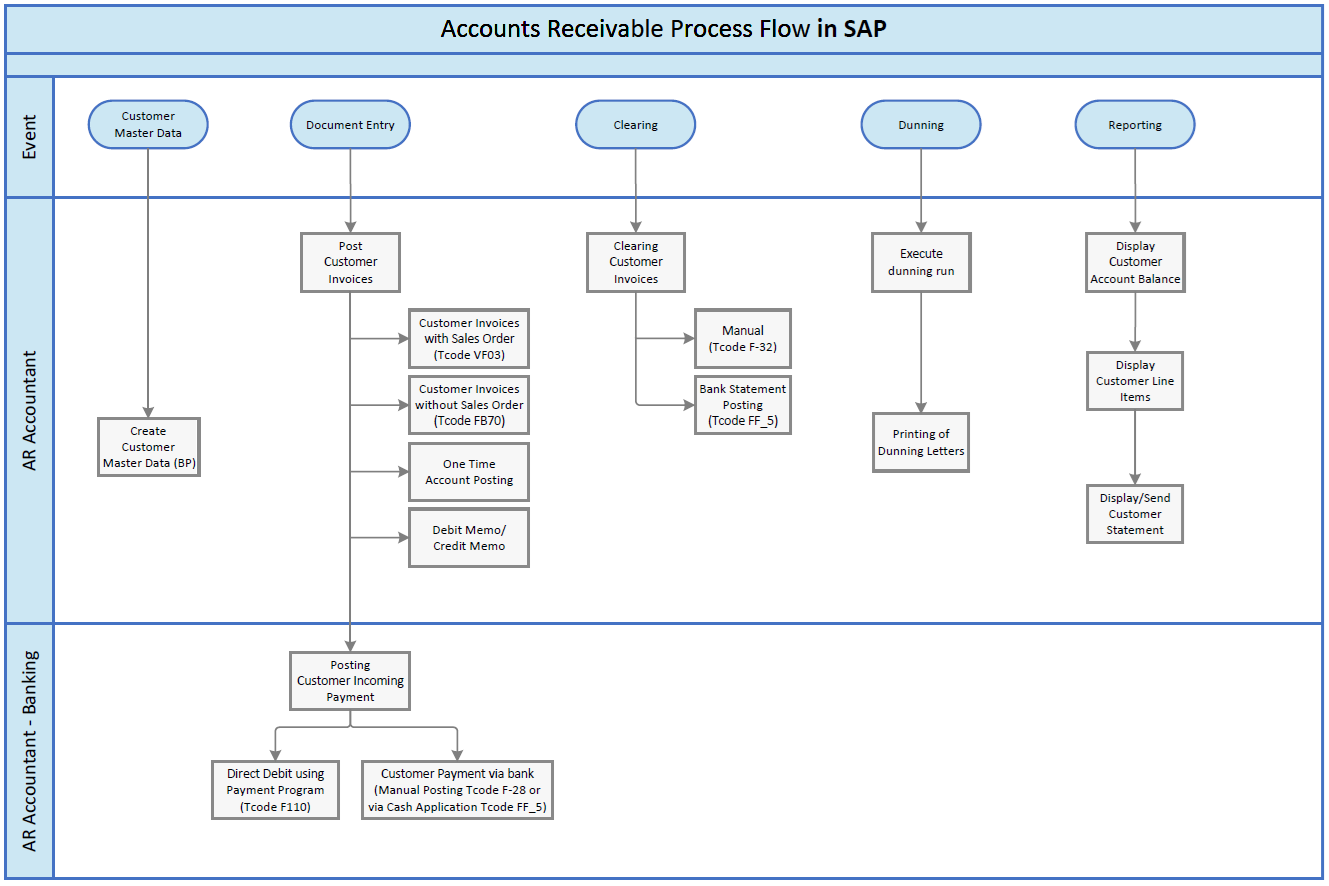

This image illustrates the diagram of the accounts receivable (FI-AR) process flow in SAP. The accounts receivable process refers to the steps a company takes to track and collect money owed by customers for goods or services that have been delivered but not yet paid for.

The process flow is broken down into various subprocesses, each with its own corresponding transaction code. Here’s a list of the main processes:

- Customer Master Data Creation via Business Partner (tcode: BP)

- Post Customer Invoices

- Post Customer Invoices with Sales Order (tcode: VF03)

- Post Customer Invoices without Sales Order (tcode: FB70)

- One Time Account Posting

- Debit Memo / Credit Memo

- Posting Customer Incoming Payment

- Direct Debit Using Payment Program (tcode F110)

- Customer Payment via ban (Manual Posting Tcode F-28 or via Cash Application Tcode FF_5)

- Clearing Customer Invoices

- Manual Clearing (tcode: F-32)

- Clearing with Bank Statement Posting (tcode: FF_5)

- Dunning in SAP

- Execute Dunning Run

- Reporting

- Display Customer Line Items

- Display Customer Invoices

- Display Customer Account Balance

- Display/Send Customer Statements