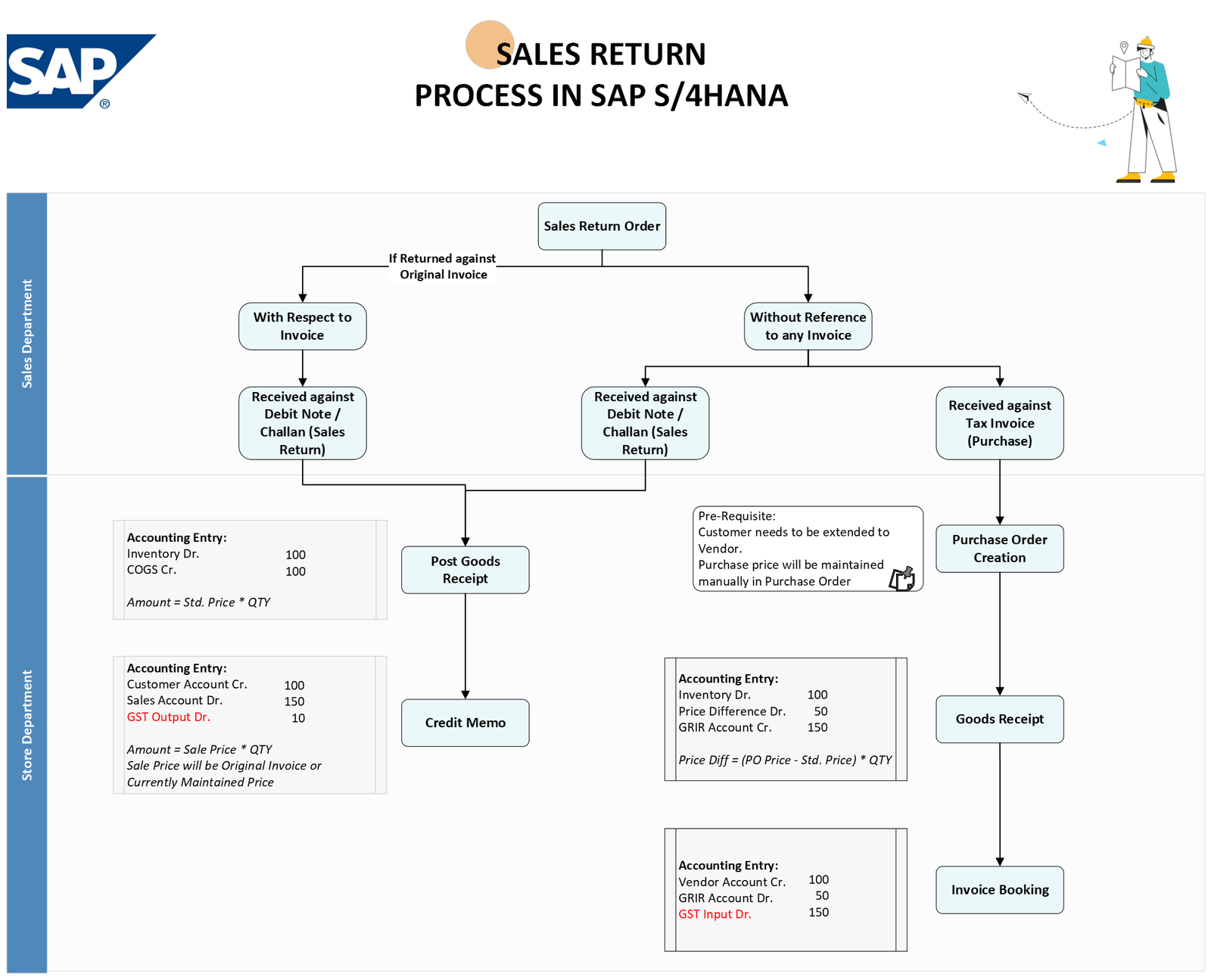

This flowchart depicts the Sales Return process in SAP S/HANA. It outlines the steps involved in processing a return from a customer, depending on whether it’s referenced against an original invoice or not.

The flowchart starts by indicating that a pre-requisite is needed: the customer needs to be extended to a vendor in the system. This likely means the customer needs to be set up as a vendor as well, so they can receive a purchase order.

There are two main paths through the flowchart, depending on whether the return is referenced against an original invoice:

- Return referenced against original invoice:

- The process begins with the creation of a Sales Return Order in the Sales Department.

- If the return is received against a debit note or challan (sales return), the accounting entries will include the customer account being credited, the sales account being debited, GST output being debited, and the GR/IR account being credited.

- If the return is received against a tax invoice (purchase), the accounting entries include the vendor account being credited, the GR/IR account being debited, and GST input being debited.

- The process begins with the creation of a Sales Return Order in the Sales Department.

- Return NOT referenced against an original invoice:

- The process begins with the creation of a Purchase Order. The purchase price will be maintained manually in the Purchase Order.

- The accounting entries include inventory being debited, and COGS being credited.

- After the goods are received, a Goods Receipt is posted.

- The accounting entries include the inventory being debited, a price difference being debited, and the GR/IR account being credited. The price difference is calculated as the difference between the PO price and standard price, multiplied by the quantity.

- An Invoice Booking is then completed.

- The accounting entries include the vendor account being credited, the GR/IR account being debited, and GST input tax being debited.

- The process begins with the creation of a Purchase Order. The purchase price will be maintained manually in the Purchase Order.

Overall, the flowchart depicts the various steps and accounting entries needed to process a sales return in SAP S/HANA, depending on how the return is referenced.