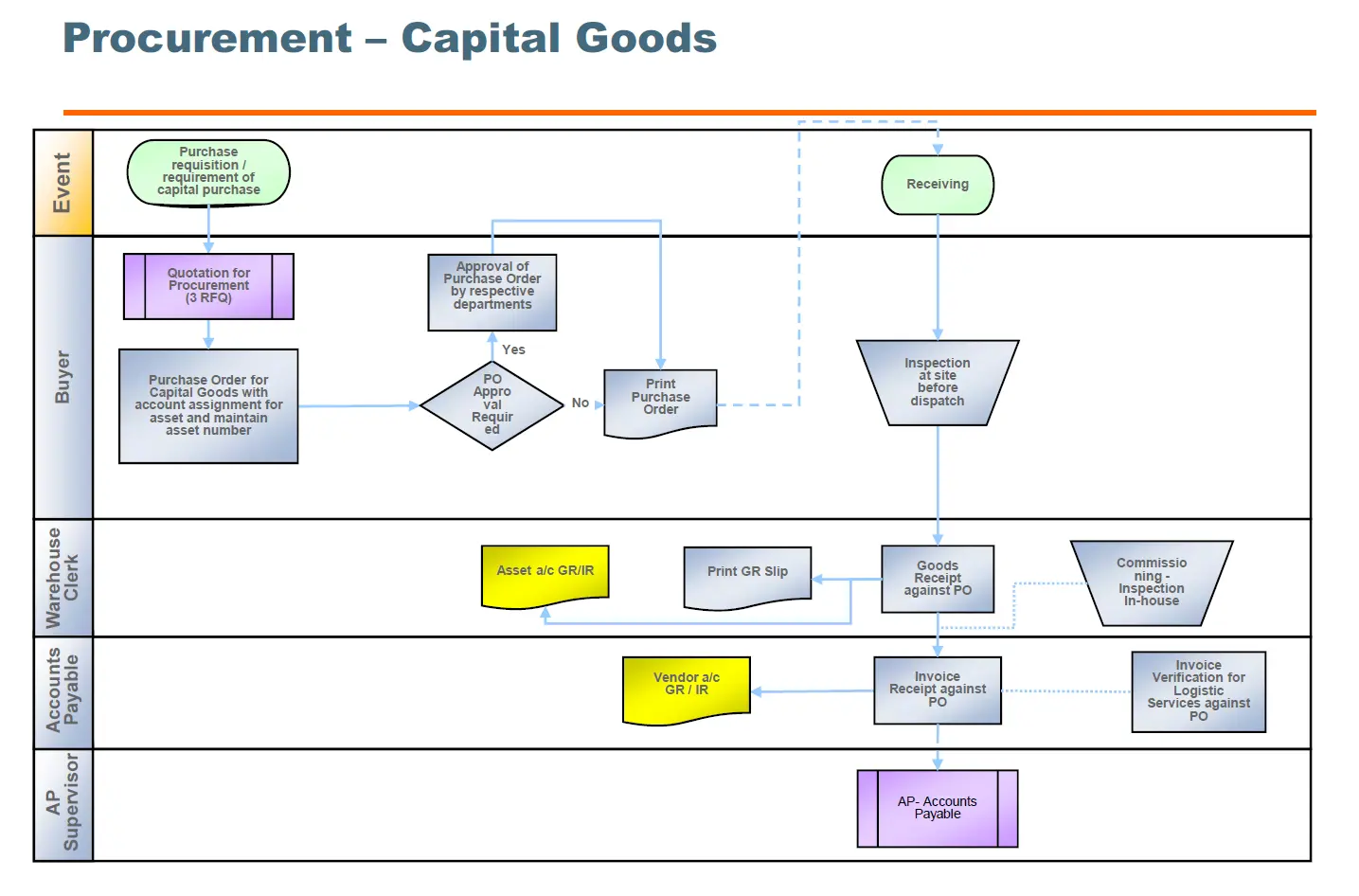

The flowchart details the SAP procurement process for capital goods (CAPEX), highlighting the necessary steps from the initial purchase requisition to the final accounts payable. It emphasizes the importance of asset management by maintaining asset numbers and G/L account numbers in the purchase order for capital items. The process includes approvals, goods receipt postings, and invoice verification, specifically for capital goods which are not held as inventory but are expensed or capitalized directly.

SAP Procurement Process for Capital Goods:

- Purchase Requisition/Requirement of Capital Purchase 📄: A requisition for capital goods is created using a short text description instead of a material number.

- Quotation for Procurement (RFQ) 📑: A request for quotation (RFQ) is sent out, resulting in a purchase order (PO).

- Purchase Order for Capital Goods 🛒: The PO is created with account assignments for asset and maintenance of asset number.

- Inspection at Site before Dispatch 🔍: An inspection is carried out to ensure the quality of the capital goods before they are dispatched to the site.

- Asset a/c GR/IR (Goods Receipt/Invoice Receipt) 📦: Upon receipt, the goods are posted in the system, and the value is directed to an asset account.

- Goods Receipt against PO 📑: The goods receipt is formally recorded against the purchase order in the system.

- Vendor a/c GR/IR 🏦: This account is used for the reconciliation of goods receipt and invoice receipt for vendor payments.

- Invoice Receipt against PO 💼: The invoice from the vendor is received and checked against the PO and goods receipt.

- Commissioning-Inspection In-house (If Applicable) 🛠️: The capital good is commissioned, and an in-house inspection is carried out, if applicable.

- Invoice Verification for Logistics Services against PO (If Applicable) 🔍: If logistics services are involved, the invoice is verified against the PO.

In this SAP process, particularly within the Financial Accounting (FI) and Asset Accounting (FI-AA) modules, capital goods procurement is managed with a focus on accurate asset recording and financial integration. Each step ensures that capital expenditures are accurately captured and reported in the company’s financial statements.