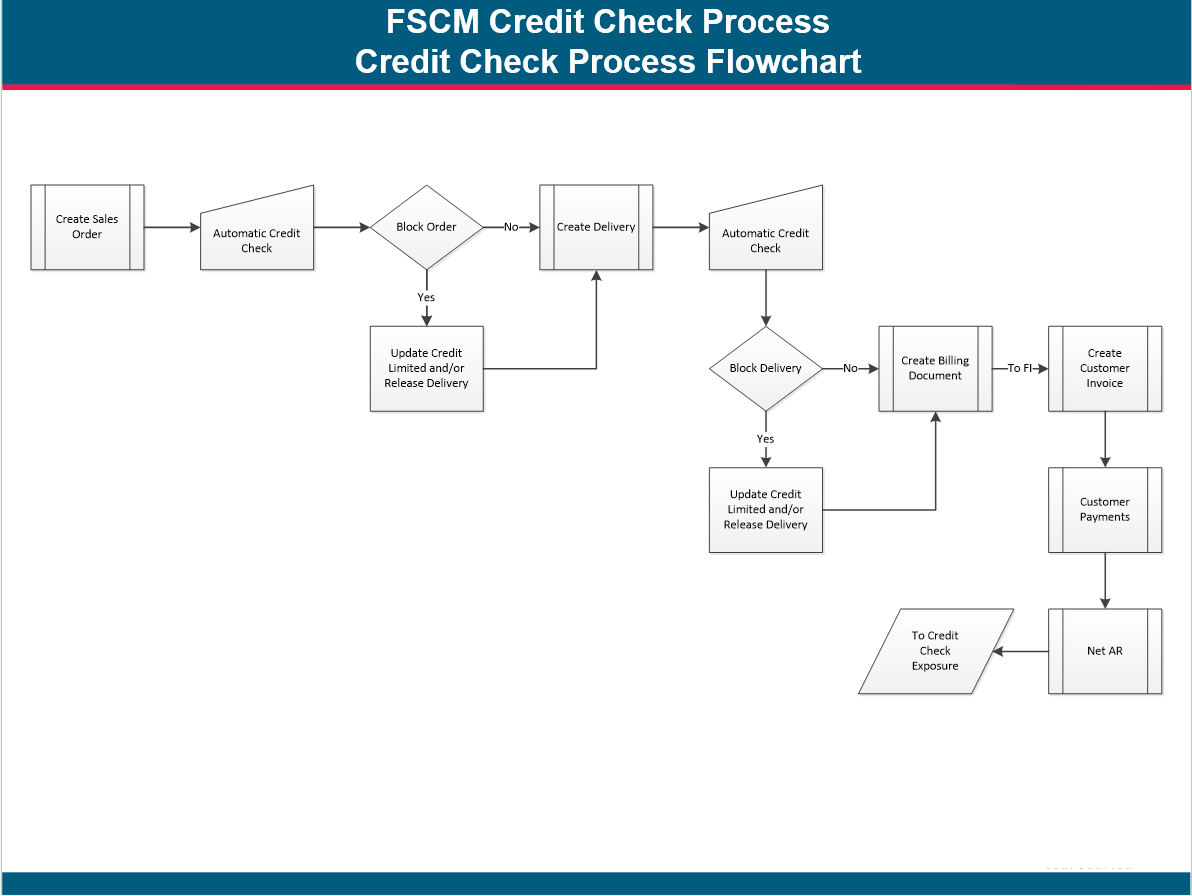

The flowchart is for the Financial Supply Chain Management (FSCM) Credit Check Process within an SAP ERP system. The flowchart shows the sequence of steps and decisions taken when processing sales orders with regard to credit checks. Here’s a description of the process:

- Create Sales Order: The process begins with the creation of a sales order in the system.

- Automatic Credit Check: Once the sales order is created, an automatic credit check is performed to assess the creditworthiness of the customer.

- Block Order (Decision point):

- If the credit check fails (Yes), the order is blocked.

- Update Credit Limit and/or Release Delivery: The credit limit for the customer is then updated, or the delivery is released if the issue is resolved.

- If the credit check is passed (No), the process moves on to create a delivery.

- If the credit check fails (Yes), the order is blocked.

- Create Delivery: The delivery is created for the sales order.

- Automatic Credit Check (Repetition): Another automatic credit check is performed at this point.

- Block Delivery (Decision point):

- If this subsequent credit check fails (Yes), the delivery is blocked.

- Update Credit Limit and/or Release Delivery: Similar to the earlier step, the credit limit may be updated or the delivery may be released after addressing the credit issue.

- If the credit check is passed (No), the process moves on to create a billing document.

- If this subsequent credit check fails (Yes), the delivery is blocked.

- Create Billing Document: The billing document is generated, which is a precursor to invoicing.

- To FI (Financial Accounting): The billing information is passed on to the financial accounting module.

- Create Customer Invoice: An invoice is created for the customer based on the billing document.

- Customer Payments: The customer makes a payment against the invoice.

- Net AR (Accounts Receivable): The payments are netted against the accounts receivable for the customer.

- To Credit Check Exposure: The outcome of the process, specifically the updated payment information, feeds back into the credit exposure for the customer, likely influencing future credit checks.

The flowchart is structured to show how credit management is integral to the sales and distribution process in an SAP ERP environment, ensuring that sales orders and deliveries are only completed if they are within the customer’s credit limit. It ensures a systematic approach to managing credit risk and cash flow.