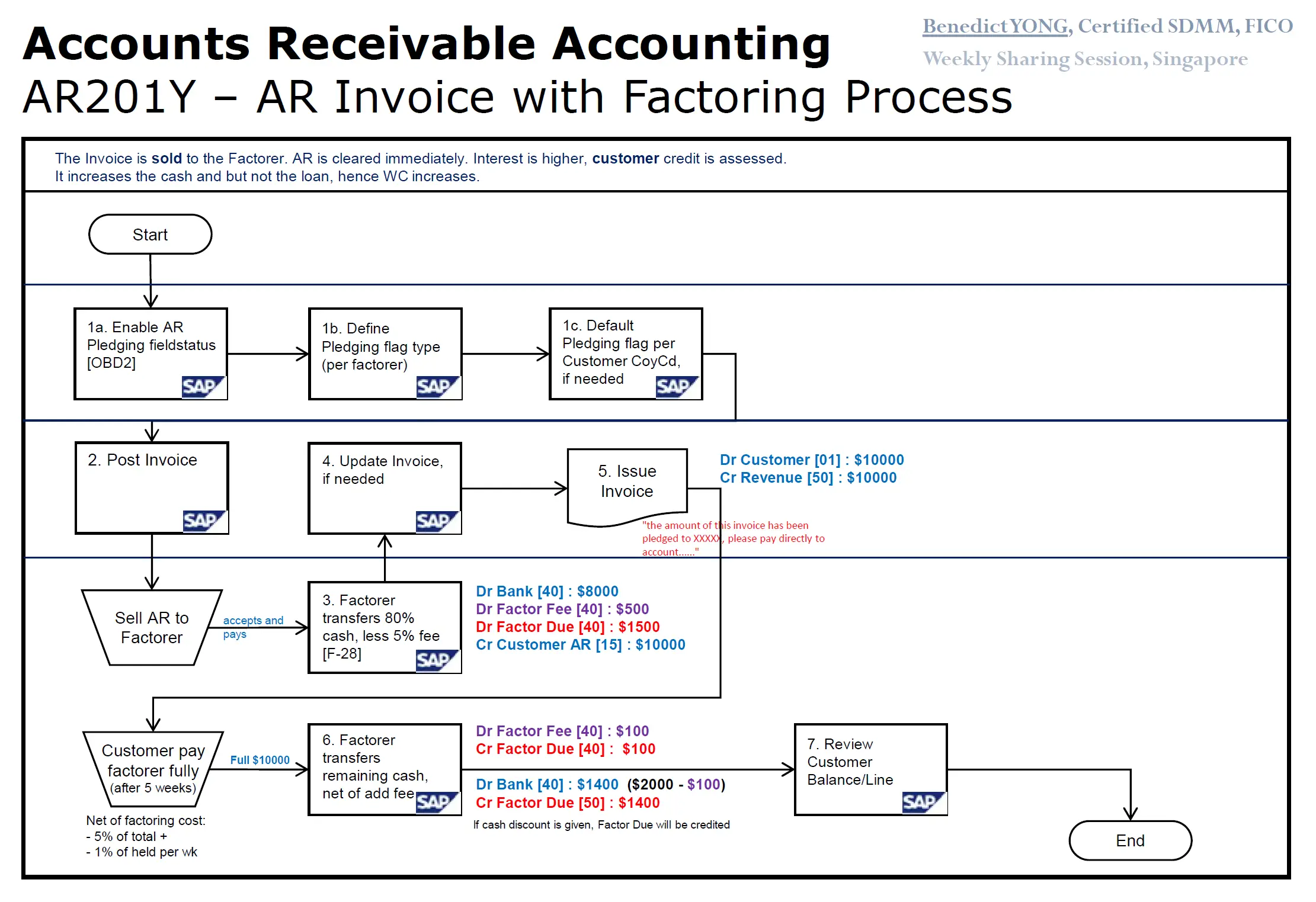

This flowchart, prepared by Benedict YONG, describes the process for managing accounts receivable where the invoices are sold to a factor (a third-party financial entity) for immediate cash, transferring the risk of customer non-payment from the company to the factor. Here’s a step-by-step overview of the flowchart:

-

- [1a]. Enable AR Pledging field status (OBD2): Set up the system to allow accounts receivable pledging.

- [1b]. Define Pledging flag type (per factorer): Define the type of pledging flag for each factorer.

- [1c]. Default Pledging flag per Customer Co/Cd, if needed: Set a default pledging flag for each customer company code if necessary.

- [2]. Post Invoice: The invoice is created and posted in the system.

- [3]. Factorer transfers 80% cash, less 5% fee (F-28): The factorer accepts the invoice and pays 80% of its value to the company, less a 5% fee. The accounting entries for this transaction are: Dr Bank [40]: $8000, Dr Factor Fee [40]: $500, Dr Factor Due [40]: $1500, Cr Customer AR [15]: $10000.

- [4]. Update Invoice, if needed: Make any required changes to the invoice after posting.

- [5]. Issue Invoice: The invoice is issued to the customer with a note stating it has been pledged to a factor and instructions for payment directly to that factor.

- Customer pay factorer fully (after 5 weeks): The customer settles the invoice by paying the full amount to the factorer after 5 weeks. The net factoring cost includes 5% of the total invoice value plus 1% of the held amount per week.

- [6]. Factorer transfers remaining cash, net of add fee: Once the factorer is paid by the customer, the remaining balance is transferred to the company, less any additional fees. The entries are: Dr Bank [40]: $1400 ($2000 – $100), Cr Factor Fee [40]: $100, Cr Factor Due [40]: $200.

- [7]. Review Customer Balance/Line: At the end of the process, there is a review of the customer’s balance or credit line.

With factoring, the invoice is sold to the factor, and accounts receivable is cleared immediately. While interest is higher than financing, the risk of customer credit is transferred to the factor, and the cash position of the company is immediately improved without increasing the loan, hence increasing working capital (WC).