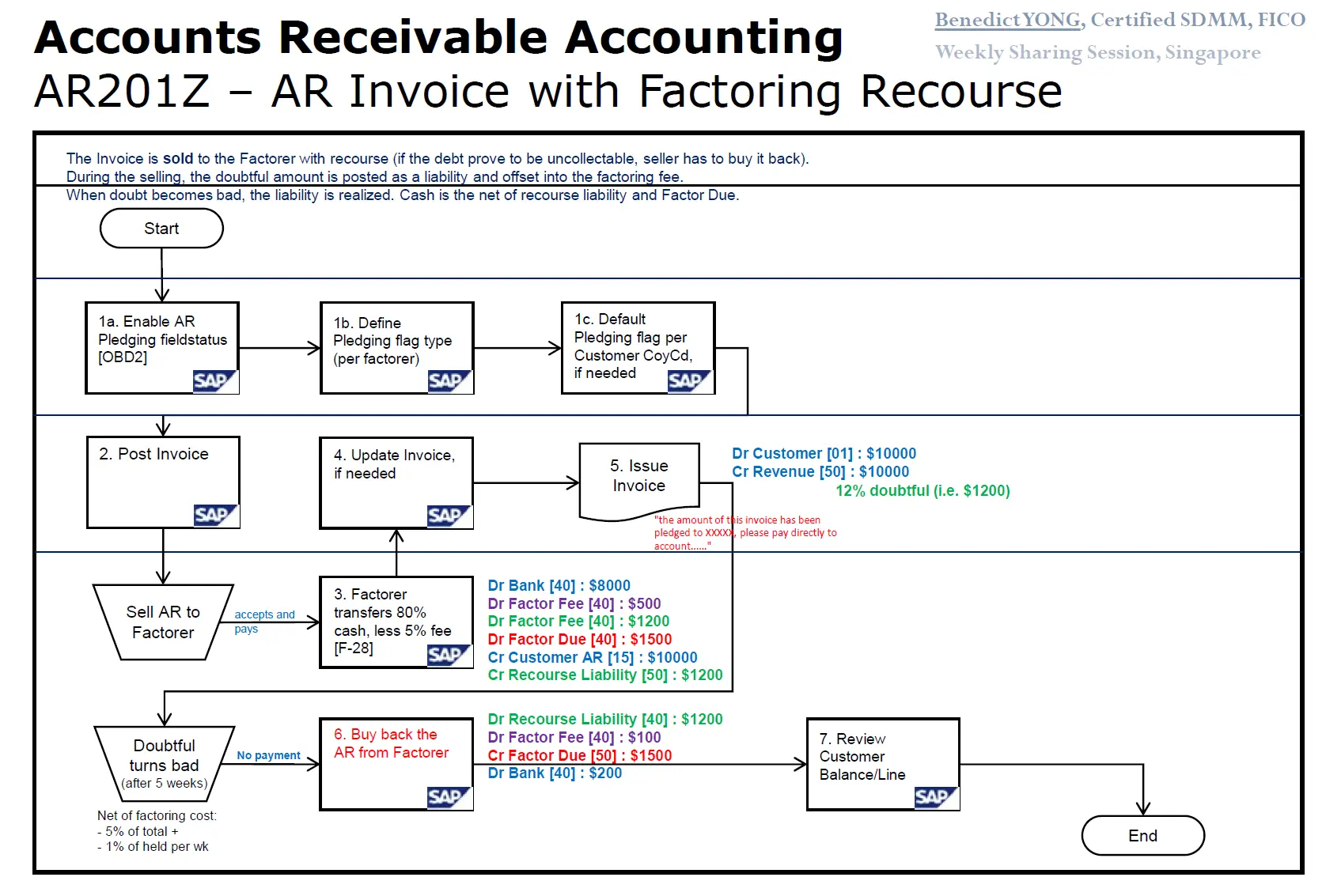

This flowchart, prepared by Benedict YONG, details how an invoice is handled when factoring with recourse is used for accounts receivable financing. Here’s the step-by-step explanation:

-

- 1a. Enable AR Pledging field status (OBD2): The company configures the SAP system to recognize accounts receivable pledges.

- 1b. Define Pledging flag type (per factorer): Specific pledging flags for each factorer are defined.

- 1c. Default Pledging flag per Customer Co/Cd, if needed: Establishes a default pledging flag for each customer company code if required.

- 2. Post Invoice: The invoice is recorded in the SAP system.

- 3. Factorer transfers 80% cash, less 5% fee (F-28): The factorer agrees to the invoice and pays 80% of its value, less a 5% fee. The relevant accounting entries are: Dr Bank [40]: $8000, Dr Factor Fee [40]: $500, Dr Factor Fee [40]: $1200, Dr Factor Due [40]: $1500, Cr Customer AR [15]: $10000, Cr Recourse Liability [50]: $1200.

- 4. Update Invoice, if needed: Any necessary modifications to the invoice are made after posting.

- 5. Issue Invoice: The invoice is issued to the customer, indicating that it has been pledged to a factor, with instructions to pay the factor directly. The invoice includes a note that 12% of its value is considered doubtful (i.e., there is a 12% chance it will not be collected).

- Doubtful turns bad (after 5 weeks)/No payment: If after 5 weeks the customer does not pay, and the doubtful amount turns into a bad debt, the company must enact the recourse terms.

- 6. Buy back the AR from Factorer: The company buys back the accounts receivable from the factorer, taking responsibility for the uncollected debt. Accounting entries for this step are: Dr Recourse Liability [40]: $1200, Dr Factor Fee [40]: $100, Cr Factor Due [50]: $1500, Dr Bank [40]: $200.

- 7. Review Customer Balance/Line: Finally, a review of the customer’s balance or credit line is done, marking the end of the process.

The flowchart indicates that in this factoring arrangement, the company retains the risk associated with the accounts receivable. If the customer fails to pay, the company must buy back the receivable from the factor. The process allows for immediate cash flow from the factor, less the fees and recourse liability. When the doubtful account becomes a bad debt, the liability is realized, and cash is the net of recourse liability and the amount due to the factor.

This process would typically be used in situations where a company needs immediate cash flow but is willing to accept the risk of having to repay the factor if the customer does not fulfill the invoice payment. The recourse liability is carried on the company’s balance sheet until it’s settled, ensuring the factor is not at risk for the doubtful portion of the receivable. The process helps manage cash flow while keeping the risk of uncollectible receivables with the company.