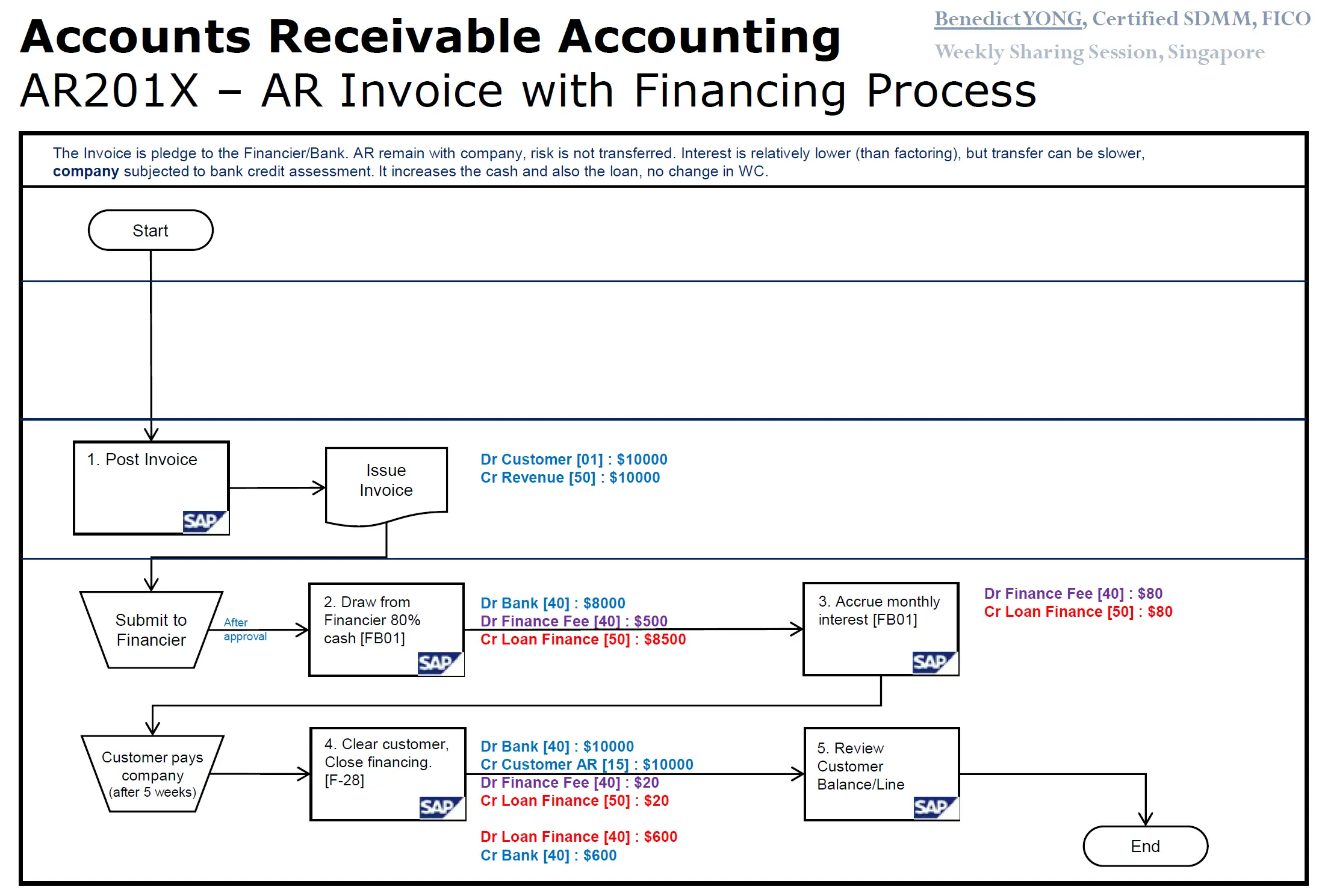

This flowchart, prepared by Benedict YONG, outlines the steps for managing accounts receivable when an invoice is financed through a third party (like a bank or financier). Here’s a breakdown of the process of pledging invoice to financer:

- Post Invoice: The invoice is generated and posted in the company’s system, which debits the customer account and credits revenue (Dr Customer [01]: $10000, Cr Revenue [50]: $10000).

- Draw from Financier 80% cash (FB01): After the invoice is approved, the company submits the invoice to a financier who provides 80% of its value in cash. This is accounted for by debiting the bank account and the finance fee while crediting the loan finance account (Dr Bank [40]: $8000, Dr Finance Fee [40]: $500, Cr Loan Finance [50]: $8500).

- Accrue monthly interest (FB01): The company accrues monthly interest on the financed amount (Dr Finance Fee [40]: $80, Cr Loan Finance [50]: $80).

- Clear customer, Close financing. (F-28): When the customer pays the company after 5 weeks, the company will clear the customer’s account and close the financing. The payment is fully recorded as it covers both the invoice and the finance fee (Dr Bank [40]: $10000, Cr Customer AR [15]: $10000, Dr Finance Fee [40]: $20, Cr Loan Finance [50]: $20, Dr Loan Finance [40]: $600, Cr Bank [40]: $600).

- Review Customer Balance/Line: Lastly, a review of the customer’s balance or credit line is conducted, indicating the end of this particular accounts receivable financing process.

This financing method involves pledging the invoice to a financier or bank but does not transfer the risk to the financier, and the accounts receivable remain with the company. It also notes that interest is relatively lower compared to factoring, but the transfer can be slower, and there’s no change in working capital as it increases both the cash and the loan amount.