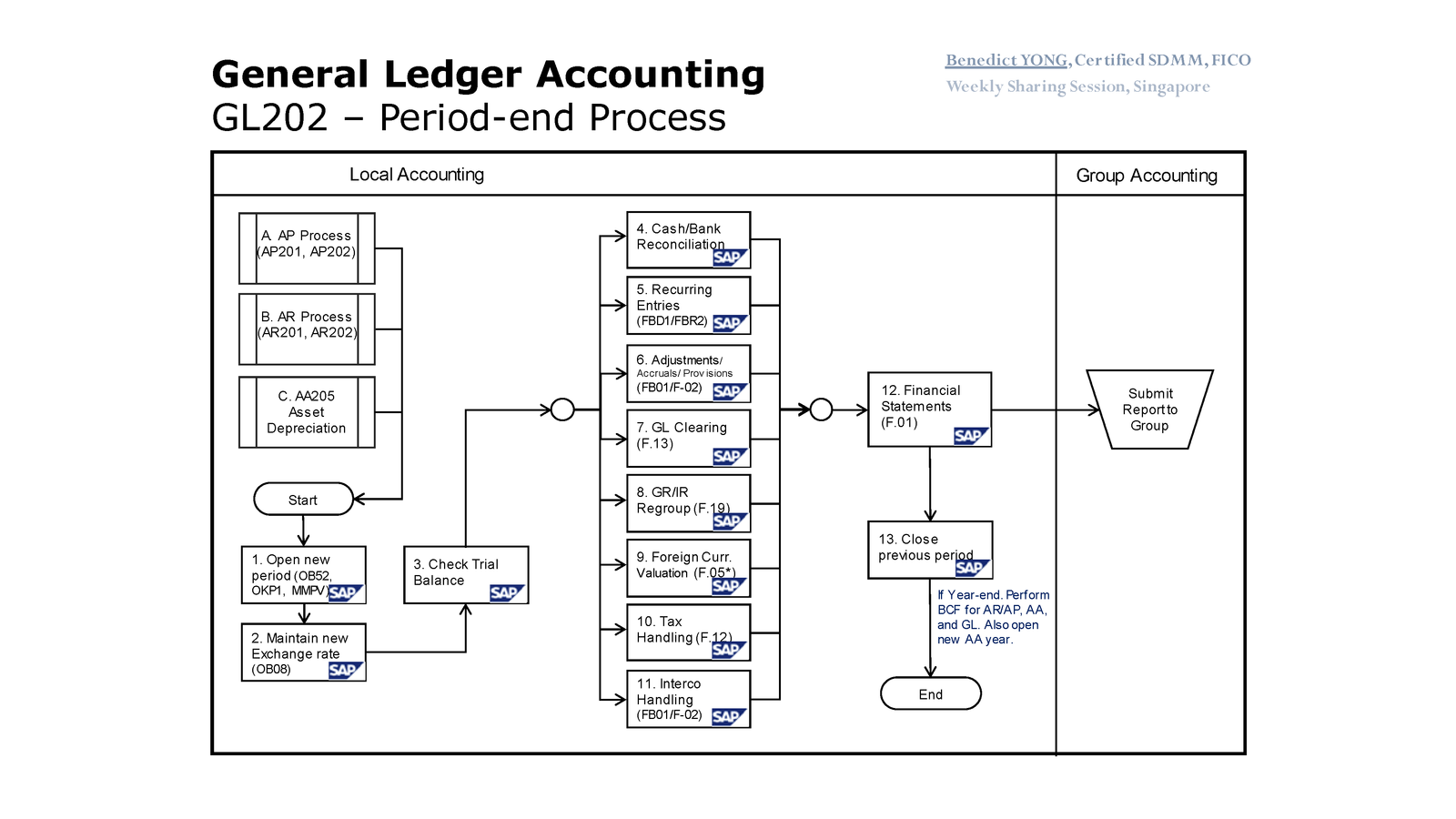

This flowchart, prepared by Benedict YONG, outlines the period end closing process flowchart in SAP Financials. It serves as a standard operating procedure for closing accounting periods. Here’s an overview based on flowchart:

-

- Open new period (OB52, OKP1, MMRV/SAP): This step involves opening a new accounting period in the SAP system.

- Maintain new Exchange rate (OB08): Updating the exchange rates for the new period.

- Check Trial Balance: Ensuring that debits and credits balance out.

- Cash/Bank Reconciliation: Matching the balance sheet accounts for cash and bank transactions to the corresponding bank statements.

- Recurring Entries (FBD1/FBR2): Recording entries that recur on a regular basis.

- Adjustments/Accruals/Provisions (FBD1/F-02): Adjusting entries for accruals and setting aside provisions.

- GL Clearing (F.13): Clearing open items in the general ledger.

- GR/IR Regroup (F.19): Reconciling goods receipts and invoice receipts accounts.

- Foreign Currency Valuation (F.05): Revaluing foreign currency balances.

- Tax Handling (F.12): Processing tax-related transactions.

- Intercompany Handling (FBD1/F-02): Handling inter-company transactions.

- Financial Statements (F.01): Generating the financial statements.

- Close previous period: Closing the books for the previous period.

If it’s the year-end, then a balance carryforward is performed for Accounts Receivable/Payable, Asset Accounting, and General Ledger, and a new Asset Accounting year is opened.