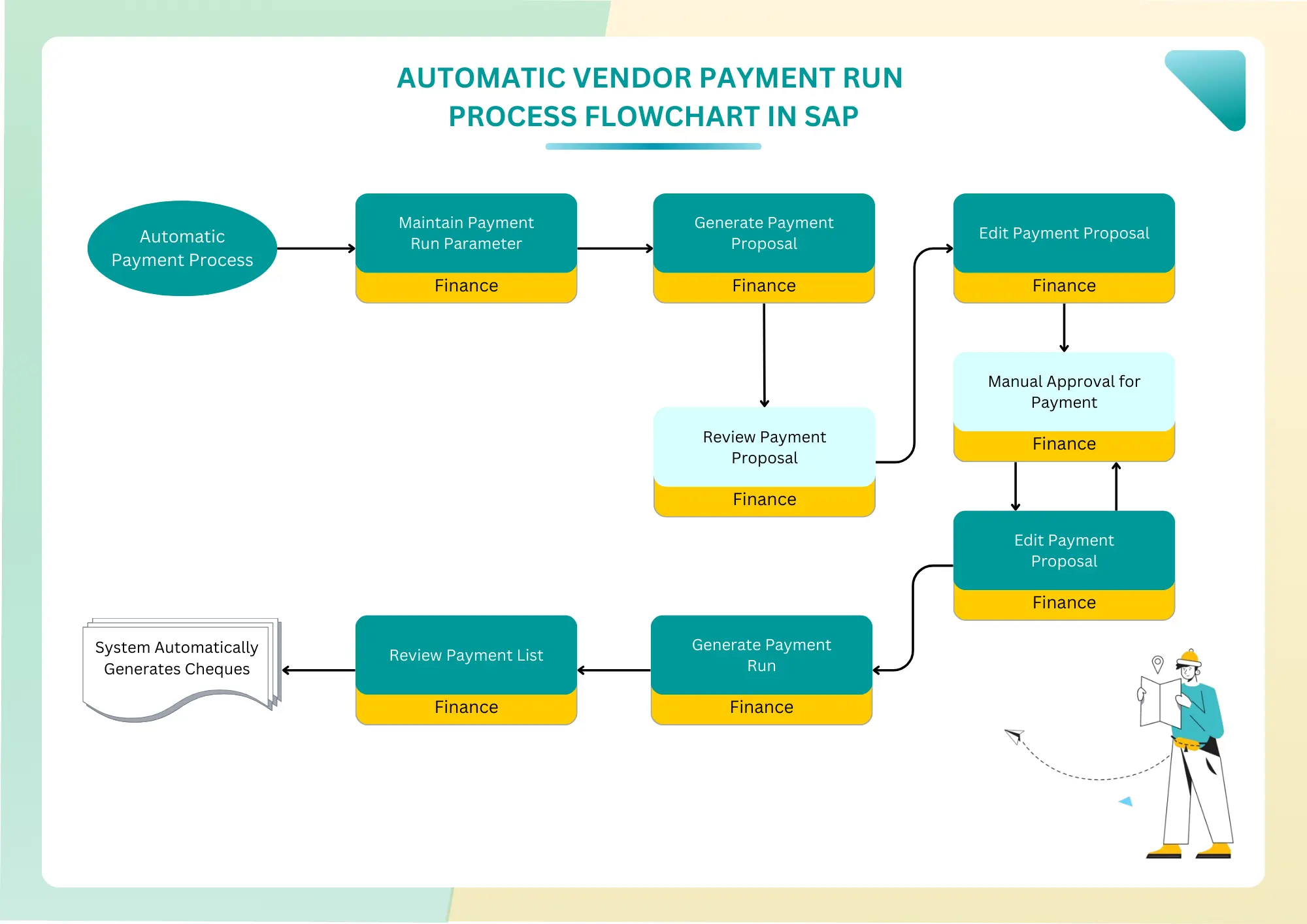

The flowchart illustrates the automatic vendor payment run process in SAP, which automates the selection and processing of vendor payments based on predefined criteria.

Below is a breakdown of process steps for flowchart image:

- Automatic Payment Process: This initial step represents the decision point where the finance team chooses to initiate the automatic payment run.

- Maintain Payment Run Parameter: This crucial step involves configuring the parameters that will govern the entire payment run. It requires a deep understanding of the company’s financial position, payment strategies, and vendor agreements. The parameters set here act as a filter, determining which payments will be included in the run and how they will be processed. Users define payment parameters, including:

- Payment execution date

- Payment period

- Company code

- Business partners to be considered

- These parameters control when and which open items are selected for payment.

- Generate Payment Proposal: This step represents the core automation of the process. The SAP system applies complex algorithms to analyze all open items against the defined parameters. It’s a comprehensive evaluation that considers various financial factors to optimize cash flow while maintaining vendor relationships.

-

- The system creates a payment proposal based on the defined parameters.

- Open items due for payment are identified and selected.

- Selection criteria include:

- Due date of items

- Company code-specific grace periods

- Minimum cash discount percentage rates

- Special G/L transaction considerations

-

- Review Payment Proposal: This step introduces a human oversight element into the automated process. It allows finance professionals to review the system’s proposals, ensuring they align with the company’s overall financial strategy. This review can be done at various levels of detail, from a high-level overview to in-depth analysis of individual line items.

- Users can view the proposal online or print it.

- The proposal provides a complete overview of all line items.

- It includes a breakdown of payment amounts sorted by:

- Countries

- Currencies

- Payment Methods

- Banks

- Edit Payment Proposal: This step provides flexibility within the automated process, allowing for manual adjustments based on real-time financial decisions or specific vendor considerations. It’s a critical phase where human insight can fine-tune the system’s proposals to better align with current business needs or unforeseen circumstances. Users can modify the proposal by:

-

- Changing payment methods

- Adjusting house bank/bank accounts

- Modifying due dates

- Altering cash discount amounts

- Blocking or unblocking payment line items

- Reassigning line items to different payments

- Changes only affect the proposal, not source documents.

-

- Manual Approval for Payment: This step represents a key control point in the process. It ensures that all proposed payments have been reviewed and approved by authorized personnel before execution. This approval process can involve multiple levels of authorization depending on the company’s governance structure and the nature of the payments.

- Generate Payment Run: This is the execution phase of the process, where the approved payment proposal is transformed into actual financial transactions. It involves complex system operations that update various financial records and prepare payment data for processing through different banking channels. Once approved, the payment run is executed.

- The system:

- Reduces bank balances

- Clears vendor open line items

- Creates payment accounting documents

- Prepares data for form printing or file output

- Payments are posted to Payment Clearing (EFT) and Cheque Clearing (Unpresented Cheques).

- The system:

- Review Payment List: This post-execution review step is crucial for ensuring the integrity of the payment process. It allows finance teams to verify that all payments were processed as intended and to identify any anomalies or errors that may require immediate attention. Users review the payment log and list to ensure successful completion.

- System Automatically Generates Cheques: This final step represents the physical output of the payment process for those vendors requiring paper cheques. It’s an automated extension of the payment run that translates electronic payment data into printed financial instruments.

For payments requiring printed cheques, the system generates them automatically.

Additional Notes

- The payment program identifies open items and selects them for payment as late as possible without losing cash discounts.

- The system can make down payments in response to down payment requests if configured.

- Various payment medium programs use the prepared data to create forms or files for different payment methods.

This automated process streamlines vendor payments, ensuring timely and accurate processing while allowing for manual oversight and adjustments as needed.