This process focuses on the depreciation of long-term assets such as buildings, machinery, equipment, furniture, parking lots, vehicles, etc., that are expected to last for more than one year but not indefinitely. Depreciation represents the systematic allocation of an asset’s cost over its useful life. Each accounting period (year, quarter, month, etc.), a portion of the asset’s cost is recorded as Depreciation Expense on the income statement, which gradually reduces the asset’s value on the balance sheet.

In SAP FI-AA, planned depreciation for fixed assets is recorded but not immediately posted to the balance sheet and profit and loss statement. Instead, these amounts are collected and posted to Financial Accounting through the periodic depreciation run, which ensures the proper reflection of asset value reduction over time.

The depreciation run can be executed periodically (annually, semi-annually, quarterly, or monthly). During this process, SAP creates accounting documents for each depreciation area and account group, following predefined posting cycles. Depending on the posting date, SAP uses:

- The last day of the period for normal periods,

- The last day of the fiscal year for special periods.

In some cases, it may be necessary to recalculate planned depreciation for various fixed assets, adjusting for changes in asset value.

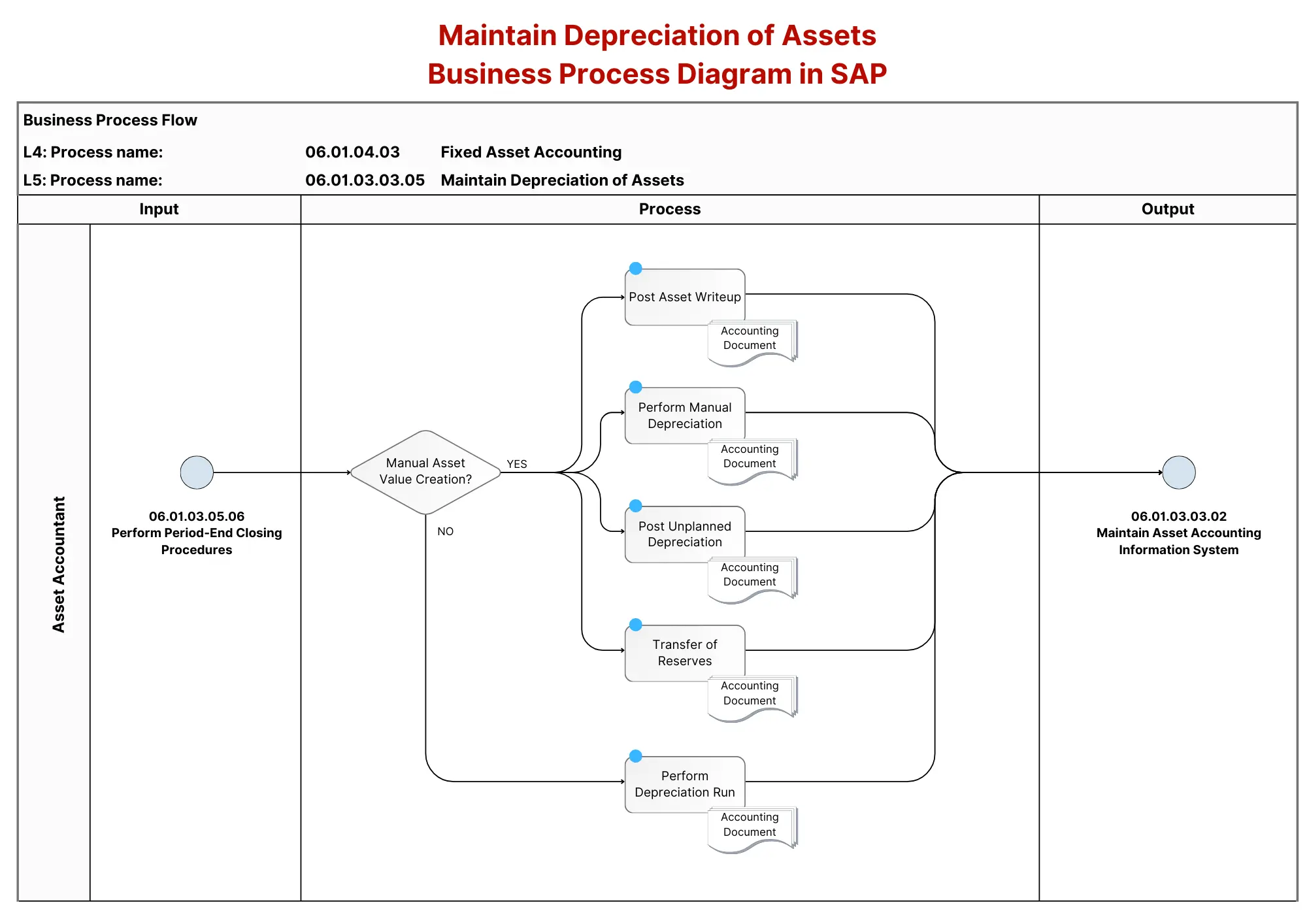

Below is a breakdown based on the detailed process steps from the SAP FI-AA Asset Depreciation flowchart image:

- Perform Period-End Closing Procedures 📅: The process starts by conducting period-end closing tasks, which ensure that the organization’s accounting periods are correctly managed and ready for depreciation processes.

- Post Asset Writeup 📝: A change in the valuation of an asset is posted. Asset write-ups typically reflect an increase in the asset’s value due to factors like renovations or improvements, and an accounting document is generated for the updated value.

- Perform Manual Depreciation ✏️: Depreciation is manually entered and posted for assets that require specific adjustments outside of the automated depreciation schedule. This manual posting generates the required accounting document for the adjusted asset values.

- Post Unplanned Depreciation ⚠️: This step involves posting any unexpected depreciation that results from the permanent reduction in an asset’s value. Examples include damages or obsolescence. An accounting document is created to reflect this depreciation.

- Transfer of Reserves 🔄: Gains or losses are recorded through reserve transfers. This step is used to manage the undisclosed reserves generated from asset sales or other financial events. The transferred reserves are either used to reduce the depreciation base for newly acquired assets or are displayed as special reserves in the balance sheet.

- Perform Depreciation Run 🔁: The system executes the scheduled depreciation run periodically (annually, semi-annually, quarterly, or monthly). The depreciation run calculates and posts the planned depreciation for all relevant assets, updating the general ledger with an accounting document for each asset and its depreciation.