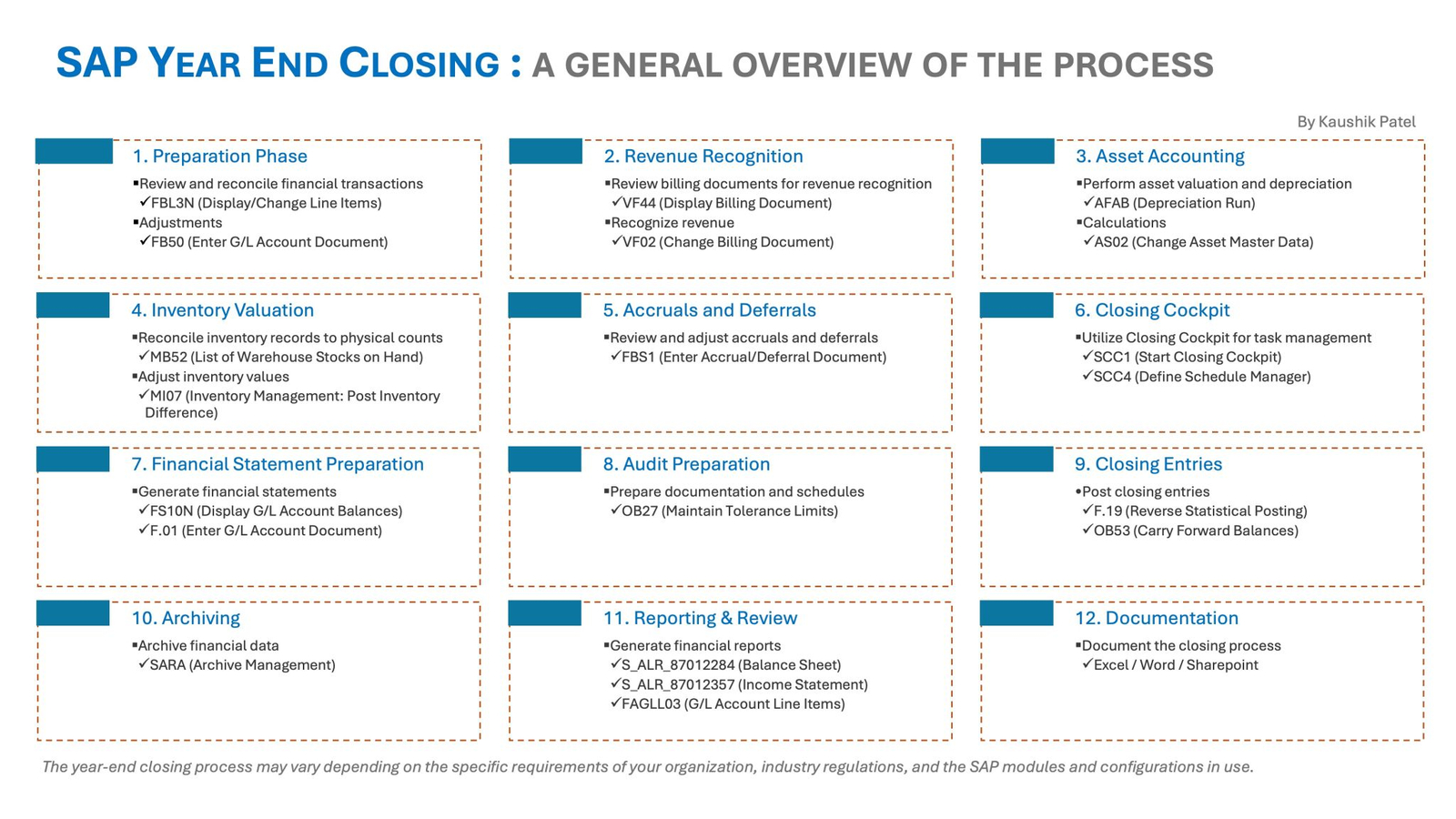

This comprehensive picture offers a structured and sequential approach to the SAP Year End Closing process, essential for ensuring all financial activities and adjustments are appropriately documented and reported.

End to end steps for year end closing process in SAP are;

- Preparation Phase In this initial phase, financial transactions from the fiscal year are reviewed and reconciled to ensure accuracy and completeness. Adjustments are made as necessary to align the financial records with actual account statuses.

- Transaction codes (t-codes) used: FBL3N, FB50

- Revenue Recognition This phase involves examining billing documents to validate revenue recognition criteria are met, ensuring revenues are accounted for in the correct fiscal period. The focus is on confirming that reported revenues are accurate and compliant with financial policies.

- Transaction codes (t-codes) used: VF44, VF02

- Asset Accounting Asset valuation and depreciation are carried out to reflect the accurate value of assets at year-end. This phase ensures assets are correctly valued on the balance sheet, incorporating any depreciation or adjustments required under applicable accounting standards.

- Transaction codes (t-codes) used: AFAB, AS02

- Inventory Valuation Physical inventory counts are reconciled with book records to adjust inventory values in the financial statements. This process helps in verifying the physical existence and condition of inventory, and accurately reporting it in the financial accounts.

- Transaction codes (t-codes) used: MB52, MI07

- Accruals and Deferrals Accruals and deferrals are reviewed and adjusted to recognize expenses and revenues in the period they occur, irrespective of the cash flows. This phase is crucial for achieving accrual-based compliance and accuracy in financial reporting.

- Transaction codes (t-codes) used: FBS1

- Closing Cockpit The Closing Cockpit is utilized to manage and automate closing tasks and schedules, streamlining the closing process and improving efficiency and accuracy.

- Transaction codes (t-codes) used: SCC1, SCC4

- Financial Statement Preparation Financial statements are generated, reflecting the company’s financial position and performance at the end of the fiscal year. This phase is critical for internal and external reporting purposes.

- Transaction codes (t-codes) used: FS10N, F.01

- Audit Preparation Preparation for audits involves creating and organizing documentation and schedules to support the audit process. This ensures readiness and compliance with auditing standards.

- Transaction codes (t-codes) used: OB27

- Closing Entries Closing entries are posted to wrap up financial activities for the year, including reversing any statistical postings and carrying forward balances to the next period.

- Transaction codes (t-codes) used: F.19, OB53

- Archiving Financial data from the closing process is archived to manage storage and ensure data integrity and accessibility for future references or audits.

- Transaction codes (t-codes) used: SARA

- Reporting & Review Financial reports are generated and reviewed, including the balance sheet and income statement, to evaluate the financial outcomes and operational effectiveness for the year.

- Transaction codes (t-codes) used: S_ALR_87012284, S_ALR_87012357, FAGLL03

- Documentation Documentation of the closing process is undertaken using various tools to record details and provide a reference for future closings or audits.