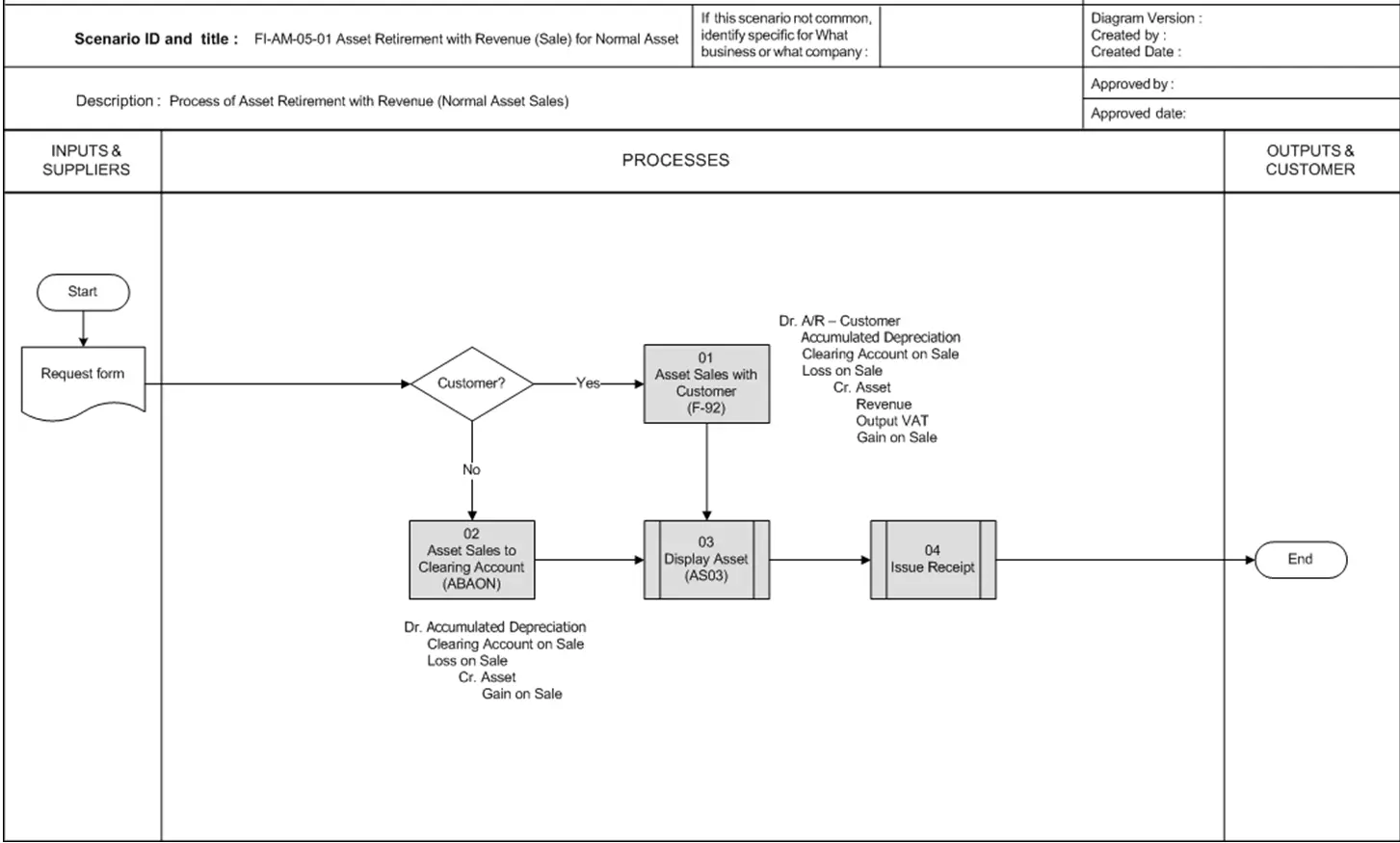

This flowchart depicts a process for retiring an asset with revenue in SAP FI-AA, which is the Fixed Assets (Asset Accounting) module. This process is used to remove an asset from the company’s asset portfolio when the asset is being sold to a customer. Here’s a breakdown of the flowchart:

- The asset retirement process starts with a request form and captures details about the asset being sold.

- If the asset is being sold to Customer then the process proceeds to “Customer Sale”. If not then it goes to “Asset Sale to Clearing Account”.

Customer Sale Path:

- This path uses transaction code F-92 which is used for sales postings for fixed assets.

- In this scenario, the customer account is debited along with the accumulated depreciation. A clearing account for asset sales is credited.

- The transaction will also record any gain or loss on the sale. The gain or loss is calculated by comparing the sales proceeds from the customer with the net book value of the asset (acquisition cost minus accumulated depreciation).

Asset Sale to Clearing Account Path:

- This path uses transaction code ABAON which is used to post retirement to a clearing account.

- In this case, the accumulated depreciation is debited and the clearing account for asset sales is credited.

- Similar to the customer sale path, this transaction will also record any gain or loss on the sale.

The process ends after the appropriate general ledger accounts have been updated to reflect the retirement of the asset.

📚Useful resources for Asset Retirement in SAP FI-AA: