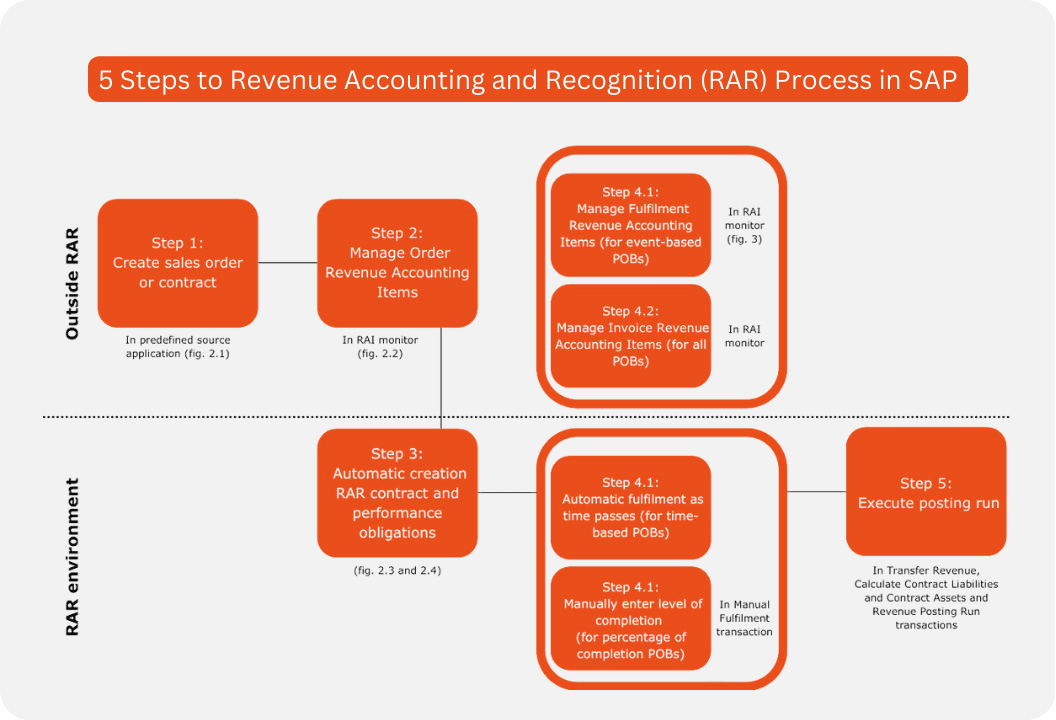

This process flow diagram depicts the core functionalities of the SAP RAR (Revenue Accounting and Recognition) add-on, clearly showing how transactions originating outside the RAR environment (sales orders, invoices) are used to create revenue accounting items which in turn update the revenue contracts through predefined rules and fulfill different obligation types before the actual revenue transfer occurs. It highlights the automation capabilities of RAR alongside the need for manual intervention in some of the fulfillment steps. The flowchart effectively visualizes the data flow and the different phases of revenue recognition in accordance with IFRS 15 requirements.

Here’s a detailed description of the process as depicted in the diagram:

Step1: Create Sales Order or Contract

- Description: Initiated outside the RAR environment, this step involves the creation of sales orders contracts in a predefined source application such as SAP SD, CRM, or third-party applications. This step is critical for identifying which documents and items are relevant for revenue accounting.

- Purpose and Scope: Sets the stage for revenue recognition by defining the sales orders contracts that will be processed through SAP RAR.

- System Interaction: Source applications are responsible for order creation, interfacing with RAR for further processing.

Step2: Manage Order Revenue Accounting Items

- Description: Also executed outside the RAR environment, this involves managing order-related revenue accounting items (RAI) using the RAI monitor (transaction FARR_RAI_MON). These items provide the necessary input for creating and managing revenue contracts.

- Purpose and Scope: Ensures that relevant order data is accurately captured and prepared for RAR contract creation.

- Data Requirements: Involves order data such as line items and billing plan invoices.

Step3: Automatic Creation of RAR Contract and Performance Obligations

- Description: Within the RAR environment, this step involves the automatic creation of revenue accounting and recognition (RAR) contracts and performance obligations. Predefined decision rules in BRF+ are used to categorize and process these actions based on the collected RAIs.

- Purpose and Scope: Formalizes the revenue contract and structures performance obligations required for revenue accounting.

- Data Handling: Relies on BRF+ decision rules for performance obligation attributes and categorization.

Step4: Manage Fulfilment and Invoice Revenue Accounting Items

- Description: This step is split into two components within the RAR environment:

- Step 4.1: Involves managing Fulfilment Revenue Accounting Items, especially for event-based performance obligations (POBs). This process updates the status of RAR contracts and their POBs as fulfillment events occur.

- Step 4.2: Manages Invoice Revenue Accounting Items, ensuring that invoices related to all POBs are accurately captured and processed.

- Purpose and Scope: Ensures performance obligations and invoices are correctly processed and aligned with fulfillment events and time-based recognition.

- System Interaction: Conducted through the RAI monitor and involves manual input when needed for certain completion types.

Step5: Execute Posting Run

- Description: This final step involves executing the posting run to perform transfer revenue calculations, calculate contract liabilities and assets, and carry out revenue postings to ledgers. This is generally done at the end of an accounting period.

- Purpose and Scope: Finalizes the revenue recognition process by posting transactions to the general ledger, thereby enabling accurate financial reporting.

- Data Outputs: Generates financial entries that reflect recognized revenues, contract assets, and liabilities.

Overall, the RAR process as described in the flowchart provides a comprehensive framework for managing revenue recognition activities in compliance with accounting standards such as IFRS 15. Each step is integral to ensuring that revenue transactions are accurately captured, processed, and reported in an organization’s financial statements.

📚Useful resources for SAP RAR (Revenue Accounting and Recognition) Process: