The Credit Management process within SAP FI-AR (or FSCM) supports organizations in evaluating the credit risk associated with customers and ensuring that business transactions comply with established credit limits. This helps mitigate the risk of losses from receivables by efficiently managing credit decisions, often through automated systems. The credit limit check can occur when sales documents are created or modified. It operates within a defined credit control area, which is associated with specific company codes and sales organizations. The system checks the customer’s credit limit based on the customer master data, considering open receivables, current sales orders, and any other credit-relevant transactions.

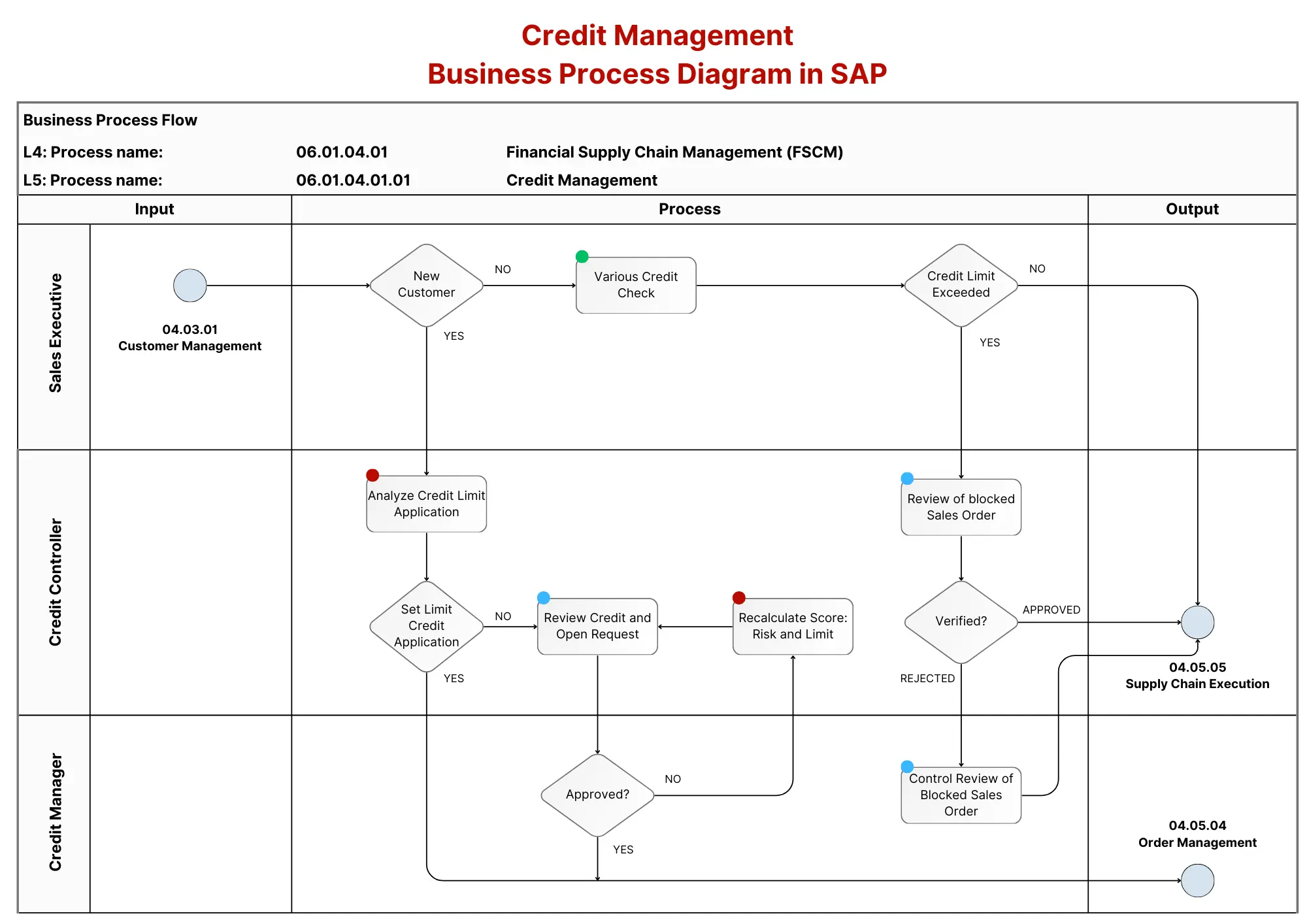

Below is a breakdown based on the detailed process steps from the SAP FI-AR Credit Management flowchart image:

- Analyze Credit Limit Application 📊: The credit controller reviews the credit limit application for a new or existing customer to assess their creditworthiness. They ensure that the customer’s liabilities, combined with the current order value, do not exceed the credit limit.

- Set Limit Credit Application 📝: After analyzing the application, the credit controller establishes or adjusts the customer’s credit limit. This ensures that the customer can continue placing orders within the set credit parameters.

- Recalculate Score: Risk and Limit 🔄: Based on the customer’s financial data and payment history, the system recalculates the customer’s credit score and adjusts the credit limit and risk category if necessary.

- Review Credit and Open Request 🔍: The credit controller revisits open requests and reviews customer accounts for pending credit decisions, ensuring all requests are appropriately managed.

- Control Review of Blocked Sales Order 🚫: Periodically, the credit controller reviews sales orders that were blocked due to exceeded credit limits or other risk factors. They evaluate whether the order can be released or should remain blocked.

- Post Asset Retirement from Sale with Customer 💼: This step applies when an asset is retired through a sale. The credit controller processes the sale and posts the transaction, ensuring that any gains or losses are recorded correctly in the accounting system.

This process ensures that credit management is integrated into customer management, allowing businesses to mitigate financial risks associated with extending credit to customers. SAP’s system facilitates both manual and automated decision-making for credit limits and approvals.