The GL Month End Closing Process in SAP concludes with critical tasks focused on finalizing financial statements, preparing reports, and ensuring compliance with corporate income tax requirements. This phase is essential for producing accurate financial reports and gaining managerial approval, culminating in a formal presentation to executive leadership. Each step in this part involves careful verification and consolidation of financial data to ensure the completeness of month-end procedures and the successful closure of the accounting period.

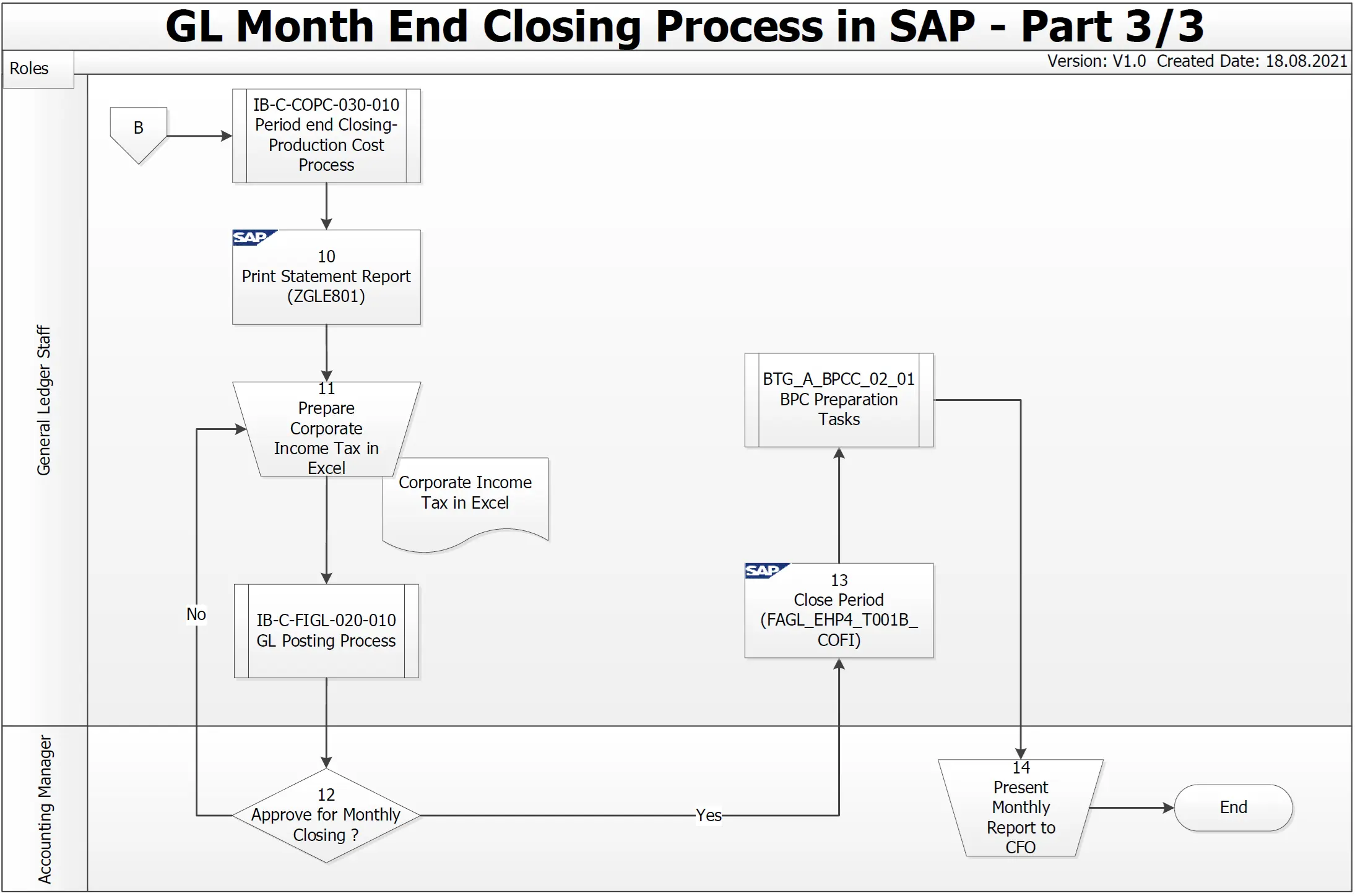

Steps shown in the GL Month End Closing Process Flowchart image:

- Period End Closing – Production Cost Process: The General Ledger Staff starts with the production cost closing process, which involves summarizing and finalizing the production cost data for the month.

- Print Statement Report: Once the production costs are finalized, a statement report is printed. This report consolidates all key financial data, serving as a reference for subsequent tax and closing activities.

- Prepare Corporate Income Tax in Excel: Corporate income tax calculations are prepared in Excel based on the finalized financial data. This ensures that all tax-related transactions are accurately recorded and organized for compliance purposes.

- GL Posting Process: If adjustments are necessary, additional general ledger postings are made. This ensures that any discrepancies or missing entries are corrected before final approval.

- Approval for Monthly Closing (Accounting Manager): The Accounting Manager reviews the prepared financial statements and tax calculations. If everything is correct, the monthly closing is approved, allowing the process to continue.

- Close Period (FAGL_EHP4_T001B_COFI): After approval, the period is officially closed using the relevant SAP transaction code. This step prevents any further postings in the closed period, ensuring the integrity of the month-end data.

- BPC Preparation Tasks: After closing the period, tasks are prepared for Business Planning and Consolidation (BPC). This step involves organizing financial data for further planning and analysis.

- Present Monthly Report to CFO: The final step in the process is to present the monthly financial report to the Chief Financial Officer (CFO). This report includes the finalized data, production costs, and tax details, summarizing the overall financial health of the organization for the month.

These steps represent the final stage of the GL Month End Closing Process, focusing on validation, reporting, and managerial approval to ensure accurate and complete financial statements.