The GL Month End Closing Process in SAP is a structured sequence of activities that ensures financial records are accurately maintained and closed at the end of each accounting period. This process involves reconciling accounts, validating data, and ensuring that all key financial activities are completed systematically. In this part of the process, various month-end procedures are carried out by the General Ledger Staff, including closing accounts payable, accounts receivable, asset transactions, and performing critical reconciliations and valuations. The goal is to present a comprehensive and accurate financial picture for the organization at the end of each month.

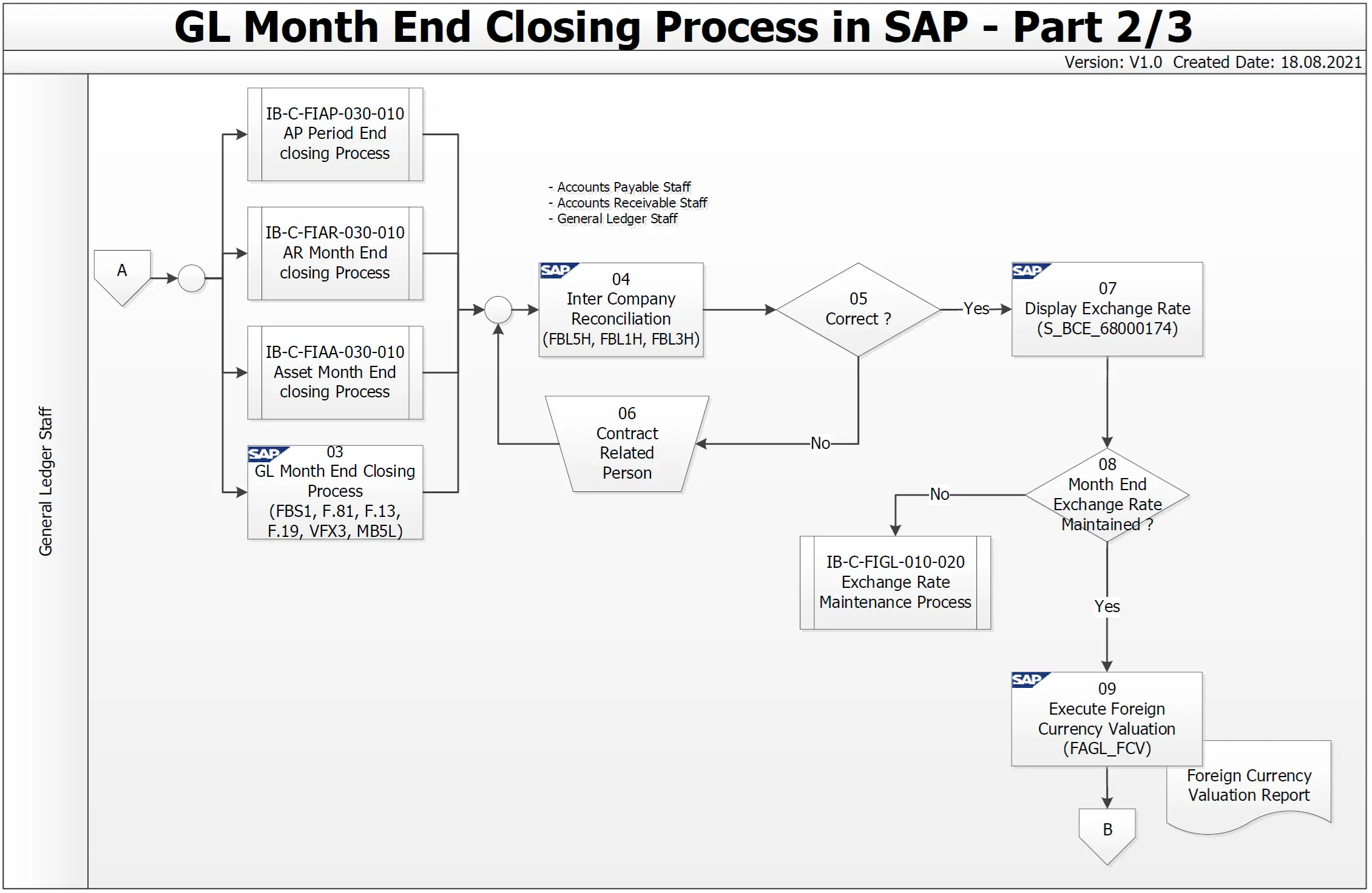

Steps shown in the GL Month End Closing Process Flowchart image:

- AP Period End Closing Process: The General Ledger Staff carries out the Accounts Payable (AP) period end closing, ensuring that all liabilities and related transactions for the period are accurately recorded.

- AR Month End Closing Process: The Accounts Receivable (AR) month end closing ensures that all outstanding receivables are appropriately documented, including payments from customers and outstanding invoices.

- Asset Month End Closing Process: This process involves closing the asset-related transactions for the period, which includes ensuring depreciation and adjustments are properly recorded.

- GL Month End Closing Process (FBS1, F.81, F.13, F.19, VFX3, MB5L): The General Ledger month-end closing involves various SAP transaction codes:

- FBS1: Accrual and deferral postings.

- F.81: Reversal of accruals/deferrals.

- F.13: Automatic clearing of open items.

- F.19: Analyze GR/IR clearing.

- VFX3: Release billing documents.

- MB5L: List of stock values.

- Inter Company Reconciliation (FBL5H, FBL1H, FBL3H): After completing the initial closing tasks, the next step is reconciling intercompany transactions. This involves verifying records between related companies to eliminate discrepancies. Key transaction codes used are:

- FBL5H: Display customer line items.

- FBL1H: Display vendor line items.

- FBL3H: Display G/L account line items.

- Contract Related Person (if discrepancies found): If any discrepancies are identified during the reconciliation, the relevant person is contacted to correct the errors.

- Display Exchange Rate (S_BCE_68000174): Once intercompany transactions are reconciled, the exchange rate is displayed to verify the correct valuation of foreign currency transactions.

- Exchange Rate Maintenance Check: The system checks whether the month-end exchange rate has been maintained. If not, the process involves maintaining the exchange rate

- Execute Foreign Currency Valuation (FAGL_FCV): If the exchange rate is correctly maintained, the General Ledger Staff proceeds to execute the foreign currency valuation to adjust the value of accounts affected by currency exchange fluctuations. This ensures that the financial data reflects accurate currency valuations at the end of the month.

These steps ensure that the month-end financial closing is carried out comprehensively, addressing accounts payable, receivables, asset transactions, and foreign currency valuation to maintain accurate and reliable financial records.