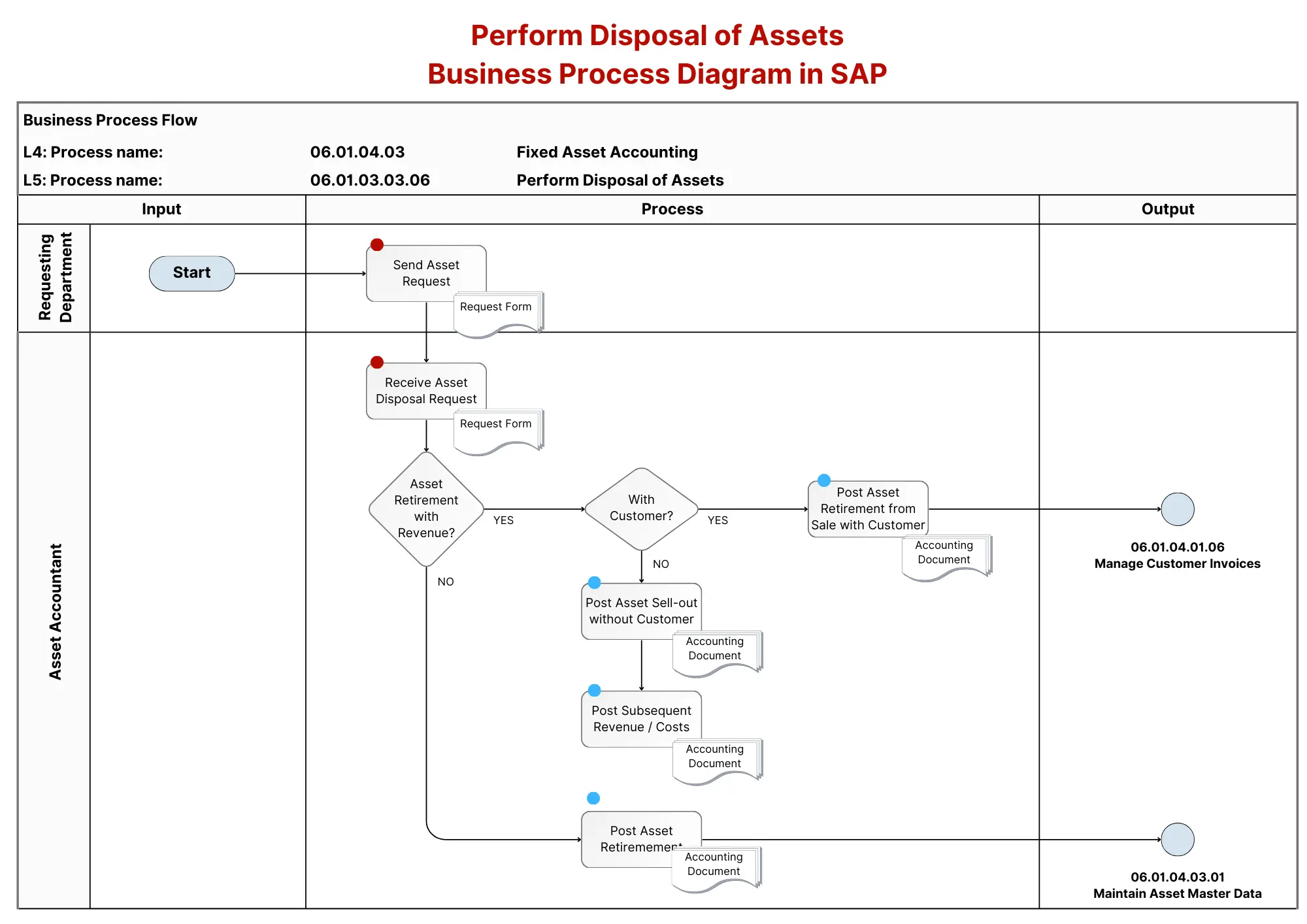

This process describes the disposal of fixed assets within SAP FI-AA. When a company disposes of an asset, the original cost and accumulated depreciation must be removed from the accounting records. Disposal may occur due to scrapping, selling the asset at a profit (resulting in a gain), or selling at a loss.

Below is a breakdown based on the detailed process steps from the SAP FI-AA Asset Disposal (Retirement) flowchart image:

- Post Asset Retirement from Sale with Customer 💼: An asset sale with a customer is posted. This transaction records the retirement of the asset, and the system calculates gains or losses automatically. An accounting document is generated to reflect the sale.

- Post Asset Sale without Customer Sale🏷️: If the asset is sold without a customer, this step posts the retirement with revenue. The gains or losses are calculated automatically, and an accounting document is generated.

- Post Asset Retirement 🚫: The asset is retired from use, regardless of revenue. The system records the retirement, calculating any gains or losses automatically, and generates an accounting document.

- Post Subsequent Revenue/Costs 💰: Any subsequent revenue or costs related to the asset after its retirement are posted. An accounting document is generated for these amounts.

This process ensures that the disposal of assets, whether with or without revenue, is properly tracked and reflected in SAP’s financial and asset accounting systems.

📚Useful resources for Asset Retirement in SAP FI-AA: