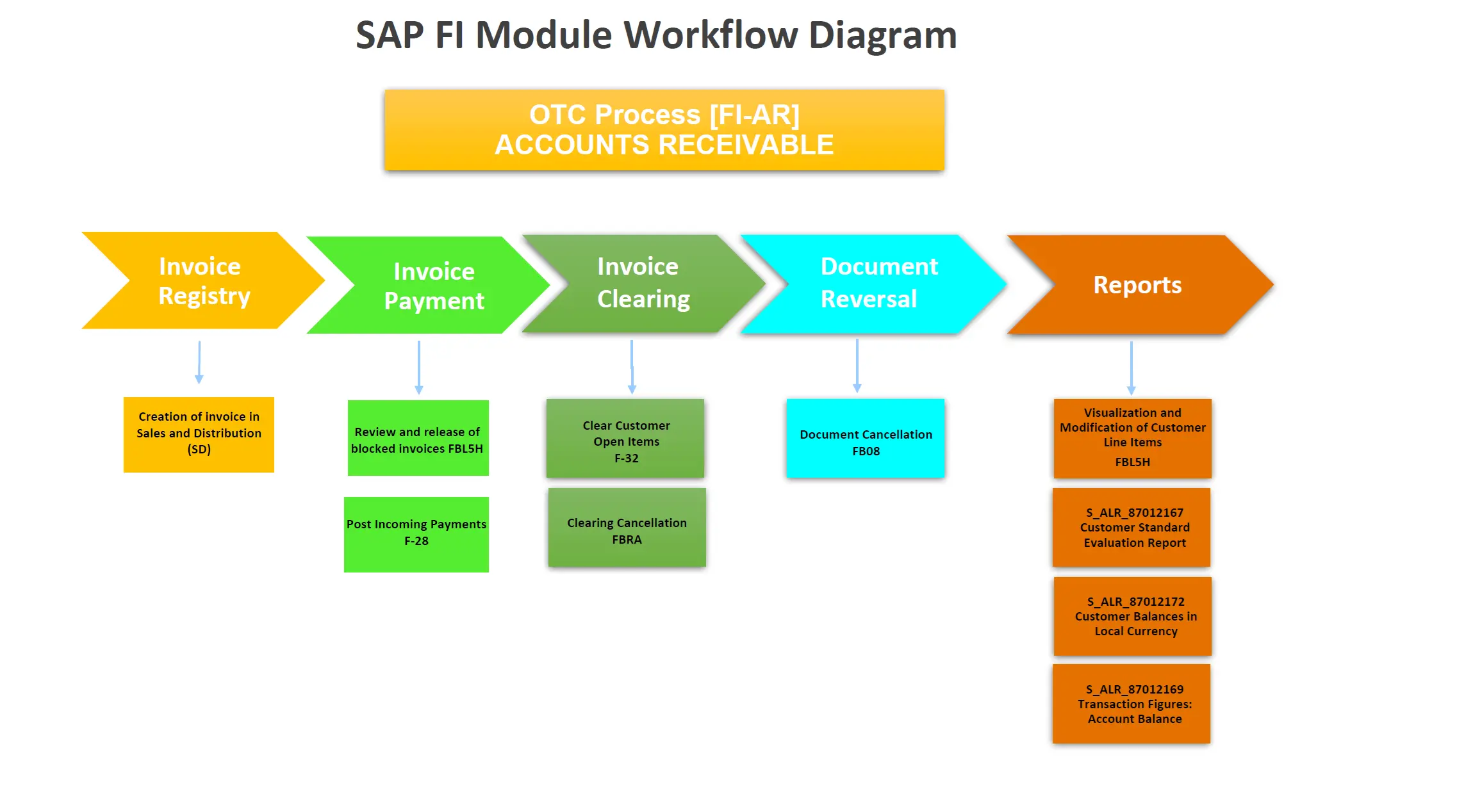

This flowchart provides an overview of the key steps in the Accounts Receivable (AR) process within the SAP FI (Financial Accounting) module, specifically focusing on the Order-to-Cash (OTC or O2C) cycle. The main steps are Invoice Registry, Invoice Payment, Invoice Clearing, Document Reversal, and Reporting.

- Invoice Registry:

- Creation of Invoice in Sales and Distribution (SD) 📄: The process begins with the creation of an invoice in the Sales and Distribution (SD) module, which may also involve credit notes.

- Invoice Payment:

- Review and Release of Blocked Invoices (FBL5H) ✅: Before posting payments, blocked invoices are reviewed and released.

- Post Incoming Payments (F-28) 💵: Posting of incoming payments against customer invoices.

- Invoice Clearing:

- Clear Customer Open Items (F-32) 📑: Clearing the open customer items in the system.

- Clearing Cancellation (FBRA) 🚫: Cancellation of clearing if necessary.

- Document Reversal:

- Document Cancellation (FB08) ↩️: Reversing the document if needed.

- Reports:

- Visualization and Modification of Customer Line Items (FBL5H) 📊: Viewing and editing customer-specific line items.

- Customer Standard Evaluation Report (S_ALR_87012167) 📈: Standard report evaluating customer transactions.

- Customer Balances in Local Currency (S_ALR_87012172) 💱: Report showing customer balances in local currency.

- Transaction Figures: Account Balance (S_ALR_87012169) 🔍: Detailed report on transaction figures and account balances.

Each step in this process is crucial for effectively managing accounts receivable, ensuring accurate tracking, payment, and reporting of financial transactions related to customer invoices within SAP.