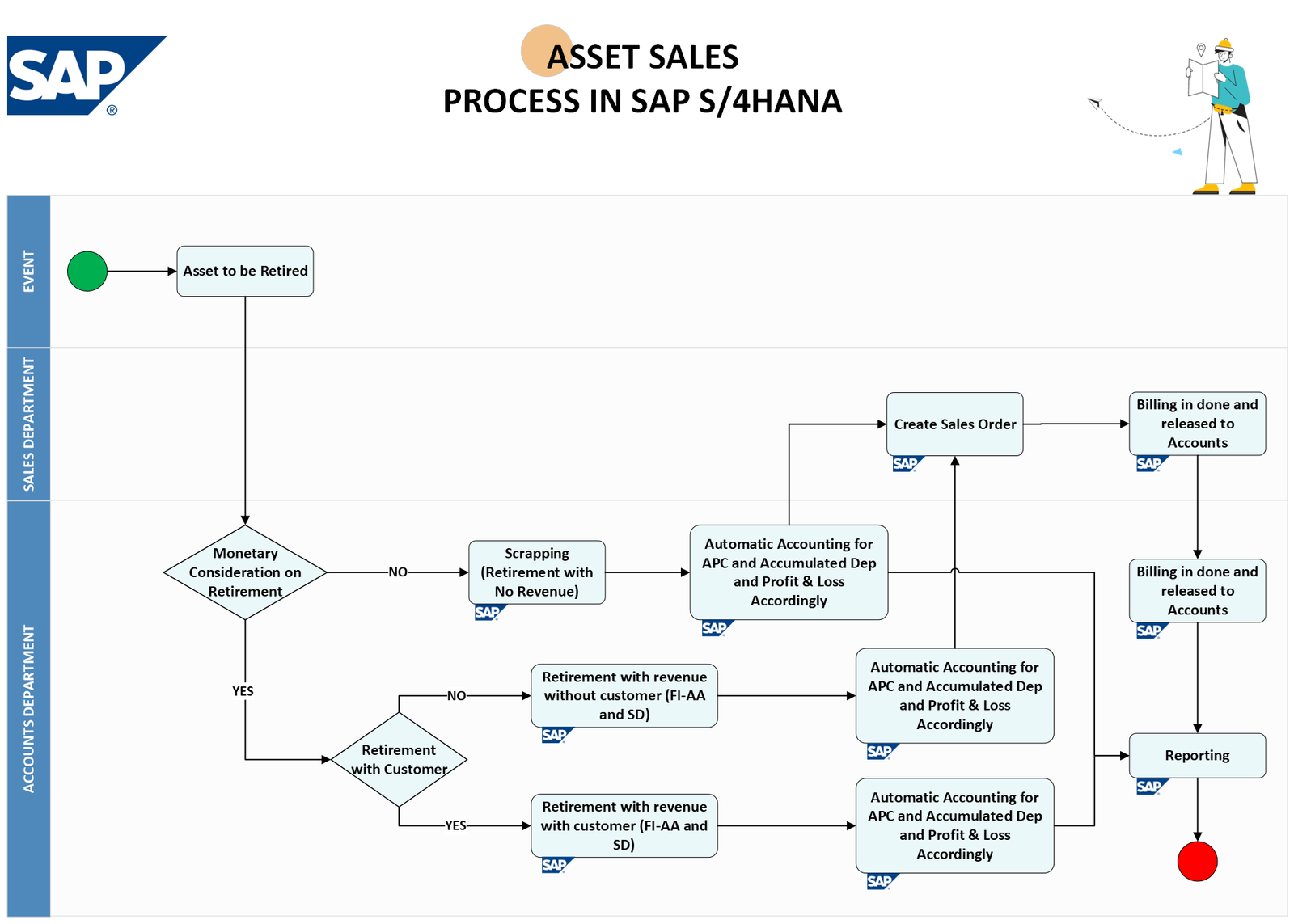

This flowchart outlines the asset sales process within SAP S/4HANA Finance Accounts Receivable (FI-AR). The process involves handling the retirement and sale of assets, ensuring proper accounting and reporting. The asset can be sold directly through finance, but if tax needs to be captured post-retirement or an invoice printout is required, the asset should be sold with a sales order. This process is similar to selling scrap without inventory. A separate sales order will be created with a non-valuated material, which does not impact financials

Prerequisites:

- Before asset retirement through Sales and Distribution (SD), the asset needs to be unblocked in the Finance (FI) module using transaction code ABAON.

Process key steps mention in the flowchart:

- Asset to be Retired: The process starts with the decision to retire an asset.

- Monetary Consideration on Retirement: Here, the flowchart branches into two paths depending on whether there’s monetary consideration involved upon retirement.

- NO Monetary Consideration (Scrapping): This path is for scrapping assets, where there’s no revenue generated from the retirement. The system automatically posts accounting entries for the asset’s accumulated depreciation and acquisition cost, with the profit or loss reflected accordingly.

- YES Monetary Consideration: This path is taken when there’s revenue to be recorded upon asset retirement. It further splits into two depending on whether there’s a customer involved.

- Retirement with Customer (FI-AA and SD): This route involves selling the asset to a customer. It requires collaboration between the FI (Finance) and SD (Sales and Distribution) modules. Here’s a breakdown of the steps:

- Create Sales Order (Tcode VA01): A sales order is created in SD for the asset. A non-valuated material is used, meaning it has no impact on inventory levels. The account assignment group in the material master data should be set to “Asset (AS)”.

- Billing is Done and Released to Accounts: Once the sales order process is complete, billing is done, and the revenue is reflected in the accounts.

- Automatic Accounting for APC and Accumulated Dep and Profit & Loss Accordingly: The system automatically posts accounting entries for the asset’s accumulated depreciation, acquisition cost, and any profit or loss incurred on the sale.

- Retirement without Customer (FI-AA): This path is chosen when the asset is sold but not to a customer. It only involves the FI module procedures. Similar to the process with a customer, the system automatically posts accounting entries for accumulated depreciation, acquisition cost, and profit or loss.

- Reporting: After the asset retirement process is complete, the relevant information is reflected in reports.